Memorex 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the Americas-Commercial reporting unit, including the assets of Encryptx, exceeded the implied fair value and, therefore, the

goodwill was fully impaired. As a result, a $1.6 million charge was recorded in 2011 in restructuring and other in the

Consolidated Statements of Operations.

During 2010, we made certain changes to our business segments. As a result of the segment change in 2010, the $23.5

million of goodwill which was previously allocated to the Electronics Products segment was merged into the Americas-

Consumer reporting unit. The Americas-Consumer reporting unit had a fair value that was significantly less than its carrying

amount prior to the combination, which is a triggering event for an interim goodwill impairment test. A two-step impairment test

was performed to identify a potential impairment and measure an impairment loss to be recognized. Based on the goodwill

test performed in the second quarter of 2010, we determined that the carrying amount of the reporting unit significantly

exceeded its fair value and that the $23.5 million of goodwill was fully impaired.

See Note 2 — Summary of Significant Accounting Policies and Note 6 — Intangible Assets and Goodwill in our Notes to

Consolidated Financial Statements as well as Critical Accounting Policies and Estimates for further background and

information on goodwill impairments.

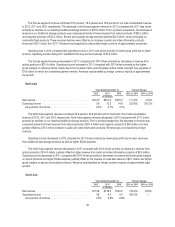

Intangible Impairments

During the fourth quarter of 2012, we determined that the results of our revised internal financial forecast, which was

finalized during the quarter and took into account the expected actions and outcomes associated with the acceleration of our

strategic transformation (as further described in above), qualified as a triggering event for impairment testing. This required

the assessment of the recoverability of the long-lived assets (including definite-lived intangible assets) included in all of our

asset groups with the exception of the recent acquisition of Nexsan. As a result of this event, we compared the carrying value

of our asset groups with their estimated undiscounted future cash flows and determined that the carrying value of certain

intangible asset groups exceeded their fair value. We generally determined our asset groups to be associated with our various

brands as that is the lowest level for which identifiable cash flows are largely independent of one another. We then calculated

the impairment of these asset groups as the excess of their carrying value over their discounted fair value and as a result we

recorded an impairment loss of $260.5 million which was recorded in the Consolidated Statements of Operations.

In calculating the discounted fair value of the asset groups, we used the income approach, a valuation technique under

which we estimate future cash flows using our financial forecasts associated with the asset groups. Our expected cash flows

are affected by various significant assumptions, including projected sales, gross margin and expense expectations as well as

a discount rate. Our analysis utilized forecasted cash flows ranging from a four year to a 10 year period depending on the

asset group, and our business plans served as the basis for these cash flow assumptions. The analysis utilized discount rates

ranging from 15.0 percent to 15.5 percent depending on the asset group. An increase in the discount rate of one percent

would have decreased the intangible asset fair value by approximately 3.0 percent while a decrease in the discount rate by

one percent would have increased the intangible asset fair value by 3.0 percent.

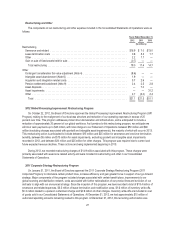

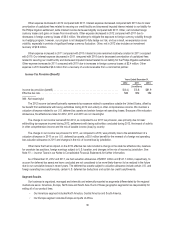

Litigation Settlements

A litigation settlement charge of $2.0 million was recognized in 2011. We entered into a settlement with Advanced

Research Corp. (ARC) under which we agreed to pay ARC $2.0 million to settle a dispute relating to a supply agreement

under which we purchased magnetic heads to write servo patterns on magnetic tape.

A litigation settlement charge of $2.6 million was recognized in 2010. On January 11, 2011, we signed a patent cross-

license agreement with SanDisk Corporation (SanDisk) to settle two patent cases filed by SanDisk in Federal District Court

against our flash memory products, including USB drives and solid state disk drives. Under the terms of the cross-license, we

will pay SanDisk royalties on certain flash memory products that were previously not licensed. The specific terms of the cross-

license are confidential. The cross-license agreement required us to make a one-time payment of $2.6 million in 2011, which

was included in litigation settlement expense in the Consolidated Statements of Operations during 2010.

See Note 15 — Litigation, Commitments and Contingencies in our Notes to Consolidated Financial Statements for

further information.

26