Memorex 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In data storage, with approximately 40 percent

margins, the Nexsan portfolio is becoming the

center of our Tiered Storage business. Together,

our products address the need for better

performance and affordability for databases,

virtual servers, public and private cloud

environments, and more. We are targeting the

underserved small and medium business (SMB)

and distributed enterprise storage, or SME,

markets with purpose-built storage systems and

appliances.

On the data security side, we advanced our

mobile portfolio in 2012 with the introduction of

Imation’s PC on a Stick™, which is certified as a

USB 3.0-based mobile workspace for deployment

of Windows To Go®. Microsoft chose only a few

partners for this product, and we are happy to be

one of them!

In order to right size the company, we

implemented cost-saving initiatives in 2012

that will continue in 2013, to cut operating

expenses by at least 25 percent over time.

We are accomplishing this through global process

improvements, office consolidations, product line

rationalization, infrastructure efficiencies

and staff reductions. These are difficult actions

but necessary for our long-term growth

and competitiveness.

We need to do fewer things better and allocate

our resources to priority growth businesses.

Therefore, with a strong focus on data storage

and data security, we announced our intent

to divest Imation’s Memorex and XtremeMac

consumer electronics businesses, and anticipate

closing on these transactions in 2013.

LOOKING FORWARD

We will continue to enhance Imation’s data

storage and security portfolio to complete our

strategic transformation. We are 100-percent

committed to returning to growth, and we are

confident that our course is correct. We anticipate

further progress on this important transformation

journey in 2013.

Sincerely,

DEAR FELLOW IMATION SHAREHOLDER,

L. White Matthews, III

Non-Executive

Chairman of the Board

Mark E. Lucas

President and

Chief Executive Officer

In our letter to you last year, we outlined Imation’s

transformation strategy, which is to leverage our

core strengths in data storage for growth in new,

higher margin product categories that address the

world’s need to store, protect and connect digital

content. We are focused on two high-growth

markets—data storage and data security—across

all channels.

After making several technology acquisitions in 2011

that began to establish our platform for growth,

we accelerated Imation’s transformation in 2012 by

taking a number of important steps, including:

• Acquiring Nexsan, a successful data

storage provider;

• Launching differentiated products;

• Restructuring our global operations to

reduce costs; and

• Exiting low-margin businesses.

Our goal is to return to growth long-term,

and our recent actions reflect that.

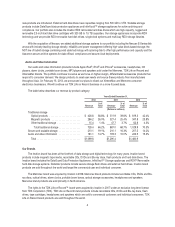

2012 FINANCIAL RECAP

Revenue totaled $1.1 billion compared with $1.3

billion in 2011. Because the secular decline in our

traditional businesses occurred more rapidly

than we expected in 2012, we accelerated

our transformation.

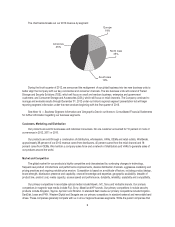

To become profitable, gross margins are a key focus

for us. We are not introducing new products unless

their margin exceeds 20 percent. The opportunity

for higher margin, differentiated products lies in our

Secure and Scalable Storage portfolio, which rose

to 21 percent of total revenues in the fourth quarter

—up from 15.7 percent a year earlier. This is the

direction we need to pursue.

Further, the Company’s gross margin rose to 18.4

percent in 2012, up from 16.8 percent the prior

year. Our goal is, at a minimum, a 20-percent gross

margin, and while we have more work to do, we are

encouraged by our progress.

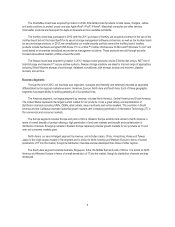

IMATION’S TRANSFORMATION

We are truly creating a new company. This

transformation is wide ranging and dramatic. It is

designed to make Imation a major player in data

storage and data security. (See graphic on inside

back cover for more information.)

As part of our transformation, we are reorganizing

the company into two business units—Tiered

Storage and Security Solutions, or TSS, and

Consumer Storage and Accessories, or CSA.

These two independently managed segments

align Imation with our key commercial and retail

segments, and provide a more customer-centric

structure—leading to faster decision making and

greater accountability.