Memorex 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

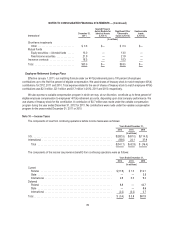

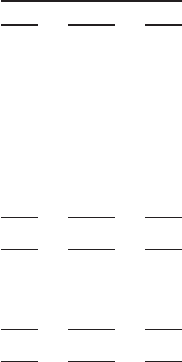

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Comprehensive Loss

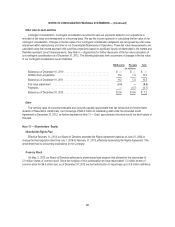

Components of comprehensive loss consisted of the following:

Years Ended December 31,

2012 2011 2010

(In millions)

Other comprehensive income (loss), net of tax:

Net unrealized (losses) gains on derivative financial instruments:

Net holding (losses) gains arising during the period ........................ $5.1 $ 0.3 $0.7

Tax benefit (expense) ........................................... (2.0) (0.1) (0.1)

Reclassification adjustment for net realized (gains) losses included in net

loss ....................................................... (3.0) 0.8 —

Tax expense (benefit) ........................................... 1.0 (0.2) —

Total net unrealized (losses) gains on derivative financial instruments ...... $1.1 $ 0.8 $0.6

Net pension adjustments:

Reclassification of adjustments for defined benefit plans recorded in net loss . . . $(0.9) $(13.0) $ 8.2

Tax benefit (expense) ........................................... (0.1) 0.3 (3.6)

Total net pension adjustments ................................... $(1.0) $(12.7) $ 4.6

Unrealized foreign currency translation (losses) gains ........................ $(1.7) $ — $ 3.0

Amounts above are presented to show each component of comprehensive loss on a gross basis and the related taxes.

Income taxes are not provided for foreign translation relating to permanent investments in international subsidiaries.

Reclassification adjustments are made to avoid double counting in comprehensive loss items that are also recorded as part of

net loss. These items are presented net of taxes in the Consolidated Statements of Comprehensive Loss.

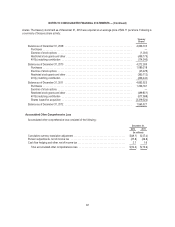

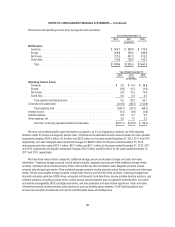

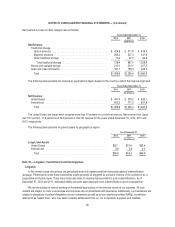

Note 14 — Business Segment Information and Geographic Data

As of and for each of the years ended December 31, 2012, 2011 and 2010, our business was organized, managed and

internally and externally reported as segments differentiated by the regional markets we serve: Americas, Europe, North Asia

and South Asia. Each of these geographic segments has responsibility for selling all of our product lines.

• Our Americas segment includes North America, Central America and South America.

• Our Europe segment includes Europe and parts of Africa.

• Our North Asia segment includes Japan, China, Hong Kong, Korea and Taiwan.

• Our South Asia segment includes Australia, Singapore, India, the Middle East and parts of Africa

For each of the years presented, we evaluated segment performance based on revenue and operating income (loss).

Revenue for each segment is generally based on customer location where the product is shipped. The operating income

(loss) reported in our segments excludes corporate and other unallocated amounts. Although such amounts are excluded

from the business segment results, they are included in reported consolidated results. Corporate and unallocated amounts

include litigation settlement expense, goodwill impairment, intangible impairments, intangible asset abandonment, research

and development expense, corporate expense, stock-based compensation expense, contingent consideration adjustments,

inventory write-offs related to our restructuring programs and restructuring and other expenses which are not allocated to the

segments.

88