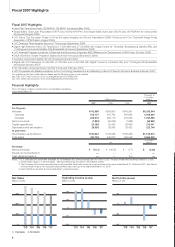

JVC 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.including moves to streamline back-office functions, as supplemental

measures we are studying whether to halve both the number of

departments in the Head Office and the number of production sites

worldwide. In addition, we are reviewing salaries and allowances in

some fields for a fixed period as an emergency measure.

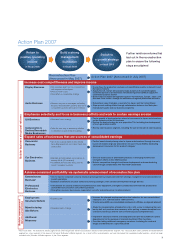

Becoming a Technology and Marketing Powerhouse to

Return to Sales Growth

To rebuild our operations, we must end the year-on-year downtrend

in our net sales and return to a growth path. While our products gar-

nered strong reviews, over the past several years this did not trans-

late into sales growth. In view of this, we will again work to shore up

our marketing activities, which some consider a weak point for JVC.

We are pushing ahead with the following priority measures, with the

goal of changing public perceptions of JVC from a technology pow-

erhouse to both a technology and marketing powerhouse.

Ensuring sales growth in the launch phase: Product life cycles

are becoming much shorter due to the rapid advance of digital tech-

nologies and the growing diversity of consumer preferences and

tastes. To expand sales, it is vital to cover all the bases in launch-

phase marketing activities. In view of this, we are negotiating with

distributors and retailers and discussing ideas for sales strategies

with them at an earlier stage than we did previously. We are building

on progress made in adopting a time-to-market approach in the cur-

rent operational reforms and further applying this approach to bring

products to market on a timely basis.

Bolstering profile-raising activities for key products: Even

when we were able to introduce products quickly and efficiently, we

did not go far enough in communicating and educating consumers

about the superior features/benefits and specifications of our prod-

ucts. Going forward, we will strengthen our prelaunch product

announcement activities based on annual sales and promotional

plans and work to obtain market recognition of the advantages of

our products by strengthening in-shop events, and thereby spur

sales growth. We will use these measures effectively to reinforce our

profile-raising activities by linking them to marketing activities to

boost launch-phase sales and expanding our sales network.

Forming strategic tie-ups with retailers and distributors: In

Japan and the Americas, we will move ahead with marketing activi-

ties specifically geared to each retail channel and extending our

sales network. To do this, we are shoring up our structure through

“”

6

profitable. Together with the consumer electronics and music enter-

tainment software businesses at the core of our corporate identity,

the professional electronics business is also a key operation, and we

will increase our focus on all these businesses.

In the consumer electronics business, we aim to improve our

earnings by strengthening the cost competitiveness of our display

and audio businesses. In particular, we can leverage our strength in

high-quality picture and sound technologies across our whole lineup

in the display business—the main driver of AV sales and the largest

growth market—to establish a strong reputation that will lead con-

sumers to ask for high-quality JVC products. To measure up to the

demands of this market, we will concentrate on LCD TVs to rebuild

our display business swiftly.

We will also build up our lineup of front projectors, which we see

as a pillar of our ILA (Image Light Amplifier) business. However, we

plan to fundamentally reassess the basic strategy of our rear projec-

tion TV business, including next-generation models. We look to

strengthen our main profitable businesses, such as video cameras

and car electronics systems, and expand their sales by directing a

large portion of our management resources to them.

In the music entertainment software business, we finished reor-

ganizing and consolidating operations to derive synergies from all

points along its path, from content development through distribution.

This allows us to take advantage of business opportunities in the

copyright and image content businesses and the growing online dis-

tribution market.

In the professional electronics business, we will strengthen our

sales of security and professional audio products and also reap syn-

ergies between the consumer video camera and professional video

camera businesses to boost global sales.

In the components & devices business and the recordable media

business, we will review each field again and consider selling some

portions.

As outlined above, we will reevaluate our entire business portfolio

so as to further step up the selectivity and focus of our operations.

Management Reforms

To recover our earnings power swiftly, we will bolster management

structural reforms by further strengthening efforts to realize a robust

management structure and operations that can move quickly. Along

with business structural reforms and employment structural reforms,

We intend to make JVC a technology and

marketing powerhouse and return to sales growth.