JVC 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

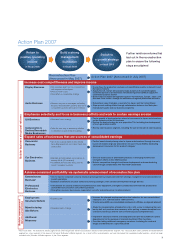

15

The music entertainment software business

plans and produces music and video con-

tent, and the media business manufactures

and sells recordable media and prerecorded

content. In fiscal 2007, sales of the Software

& Media segment were 92% of the level a

year earlier, at ¥95.2 billion. The segment

booked an operating loss of ¥1.9 billion, a

¥4.5 billion deterioration from the figure a

year before.

500 100 150 200

’07

’06

’05

’04

’03

95.2

103.9

95.9

148.0

167.5

Sales (Billions of yen)

Share of Total FY2007 Sales

12.8%

Software & Media

JVC’s music entertainment software business comprises a number

of key companies, including Victor Entertainment, Inc., and Teichiku

Entertainment, Inc., which produce and sell music software.

In fiscal 2007, music CD production costs in Japan fell against the

level a year earlier and sales of prerecorded music DVDs inched

down. Against this backdrop, despite hits by pop-rock bands

Remioromen and SMAP, overall sales at Victor Entertainment were

slack due to a lack of hit releases in the second half. Sales increased

at Teichiku Entertainment on the strength of a major hit by singer

Masafumi Akikawa and other releases.

In fiscal 2008, the music entertainment software business is reor-

ganizing the structure and functions of its entire operations. Victor

Entertainment concentrates on music content planning, production,

and marketing, and is increasing investment in order to discover

new artists and produce hit releases.

Formed on April 1, 2007, JVC Entertainment, Inc., unified the video

content planning and production operations that had been dispersed

within the Company. It plans to capitalize on major business opportuni-

ties with the addition of advertising and electronic distribution businesses.

Teichiku Entertainment is doing well and continues to strengthen

its presence in original music and movies.

Recordable media’s changeover to discs from tapes accelerated in

fiscal 2007. The digital video camera (DVC) market shrank accord-

ingly. While unit sales of DVD-related products grew, the decline in

prices gathered speed. These trends also contributed to the decline

in sales for the recordable media business.

Despite the negative impact caused by the rapid spread of music

software downloading and the slump in overseas game software,

overall sales of prerecorded software edged down only slightly

thanks to our solid showing in DVD software.

In fiscal 2008, we will shift to higher-value-added products in the

recordable media business, including dual-layer DVD “DL” and 8cm

DVDs. We will restructure our sales organi-

zation in Japan and worldwide, press

ahead with sweeping structural

reforms in response to the rapidly

evolving market, and reinforce

our competitive strengths.

In prerecorded software,

we will enhance corporate

value through management

that derives synergies from

Group software companies, includ-

ing Victor Entertainment.

Media Business

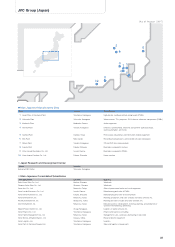

DVD-RW Disk

Our 8cm DVD-RW disks for video cameras

use JVC’s original Ultra Hard Coat disk

surface protection technology and

deliver outstanding quality and

reliability through integrated

domestic production.

Music Entertainment Software Business

Remioromen

HORIZON

Masafumi Akikawa

Sen no Kaze ni Notte

(A Thousand Wings)

SMAP

Pop Up! SMAP