JVC 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

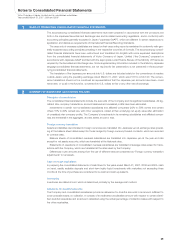

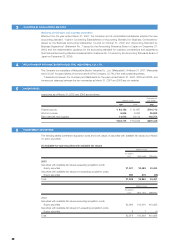

3CHANGES IN ACCOUNTING METHOD

Business combination and business separation

Effective from the year ended March 31, 2007, the Company and its consolidated subsidiaries adopted the new

accounting standard, “Opinion Concerning Establishment of Accounting Standard for Business Combinations”

issued by the Business Accounting Deliberation Council on October 31, 2003 and “Accounting Standard for

Business Separations” (Statement No. 7 issued by the Accounting Standards Board of Japan on December 27,

2005) and the implementation guidance for the accounting standard for business combinations and separations

(the Financial Accounting Standard Implementation Guidance No. 10 issued by the Accounting Standards Board of

Japan on December 22, 2006).

4RELATIONSHIP WITH MATSUSHITA ELECTRIC INDUSTRIAL CO., LTD.

The Company is a subsidiary of Matsushita Electric Industrial Co., Ltd. (“Matsushita”). At March 31, 2007, Matsushita

held 133,227 thousand shares of common stock of the Company, 52.7% of the total outstanding shares.

Transactions between the Company and Matsushita for the years ended March 31, 2007, 2006 and 2005, and

the account balances between the two companies at March 31, 2007 and 2006 are not material.

5INVENTORIES

Inventories as of March 31, 2007 and 2006 are as follows:

Thousands of

Millions of yen U.S. dollars

2007 2006 2007

Finished goods ¥083,156 ¥91,687 $704,712

Work in process 6,606 9,295 55,983

Raw materials and supplies 14,013 18,113 118,754

¥103,775 ¥119,095 $879,449

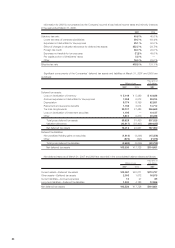

6INVESTMENT SECURITIES

The following tables summarize acquisition costs and book values of securities with available fair values as of March

31, 2007 and 2006:

(1) Available-for-sale securities with available fair values

Millions of yen

Acquisition

cost Book value Difference

2007:

Securities with available fair values exceeding acquisition costs:

Equity securities ¥1,001 ¥5,485 ¥4,484

Securities with available fair values not exceeding acquisition costs:

Equity securities 398 375 (23)

Total ¥1,399 ¥5,860 ¥4,461

Millions of yen

Acquisition

cost Book value Difference

2006:

Securities with available fair values exceeding acquisition costs:

Equity securities ¥2,966 ¥13,461 ¥10,495

Securities with available fair values not exceeding acquisition costs:

Equity securities 8 7 (1)

Total ¥2,974 ¥13,468 ¥10,494

42