JVC 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

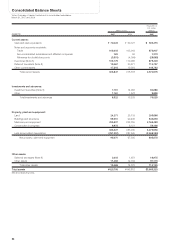

1BASIS OF PRESENTING CONSOLIDATED FINANCIAL STATEMENTS

The accompanying consolidated financial statements have been prepared in accordance with the provisions set

forth in the Japanese Securities and Exchange Law and its related accounting regulations, and in conformity with

accounting principles generally accepted in Japan (“Japanese GAAP”), which are different in certain respects as to

application and disclosure requirements of International Financial Reporting Standards.

The accounts of overseas subsidiaries are based on their accounting records maintained in conformity with gen-

erally accepted accounting principles prevailing in the respective countries of domicile. The accompanying consoli-

dated financial statements have been restructured and translated into English with some expanded descriptions

from the consolidated financial statements of Victor Company of Japan, Limited (“the Company”) prepared in

accordance with Japanese GAAP and filed with the appropriate Local Finance Bureau of the Ministry of Finance as

required by the Securities and Exchange Law. Some supplementary information included in the statutory Japanese

language consolidated financial statements, but not required for fair presentation, is not presented in the accompa-

nying consolidated financial statements.

The translation of the Japanese yen amounts into U.S. dollars are included solely for the convenience of readers

outside Japan, using the prevailing exchange rate at March 31, 2007, which was ¥118 to U.S.$1.00. The conven-

ience translations should not be construed as representations that the Japanese yen amounts have been, could

have been, or could in the future be, converted into U.S. dollars at this or any other rate of exchange.

2SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

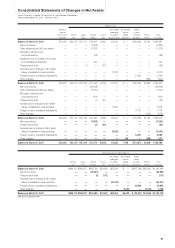

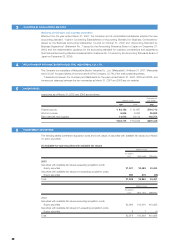

Principles of consolidation

The consolidated financial statements include the accounts of the Company and its significant subsidiaries. All sig-

nificant inter-company transactions, account balances and unrealized profits have been eliminated.

Investments in certain non-consolidated subsidiaries and affiliated companies (20% to 50% owned and certain

others 15% to 20% owned) are, with minor exceptions, stated at their underlying net equity value after elimination

of unrealized inter-company profits. The Company’s investments in its remaining subsidiaries and affiliated compa-

nies are immaterial in the aggregate, and are stated at cost or less.

Foreign currency translation

Assets and liabilities denominated in foreign currencies are translated into Japanese yen at exchange rates prevail-

ing at the balance sheet dates except for those hedged by foreign currency forward contracts, which are recorded

at contract rates.

Balance sheets of consolidated overseas subsidiaries are translated into Japanese yen at the year-end rate

except for net assets accounts, which are translated at the historical rates.

Statements of operations of consolidated overseas subsidiaries are translated at average rates except for trans-

actions with the Company, which are translated at the rates used by the Company.

Differences in yen amounts arising from the use of different rates are presented as “Foreign currency translation

adjustments” in net assets.

Cash and cash equivalents

In preparing the consolidated statements of cash flows for the years ended March 31, 2007, 2006 and 2005, cash

on hand, readily available deposits and short-term highly liquid investments with maturities not exceeding three

months at the time of purchase are considered to be cash and cash equivalents.

Inventories

Inventories are stated at cost, which is determined primarily by the average-cost method.

Allowance for doubtful accounts

The Company and consolidated subsidiaries provide an allowance for doubtful accounts in an amount sufficient to

cover probable losses on collection. It consists of an estimated uncollectible amount with respect to certain identi-

fied doubtful receivables and an amount calculated using the actual percentage of collection losses with respect to

the other receivables.

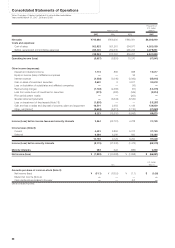

Notes to Consolidated Financial Statements

Victor Company of Japan, Limited and its consolidated subsidiaries

Years ended March 31, 2007, 2006 and 2005