JVC 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

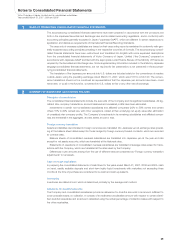

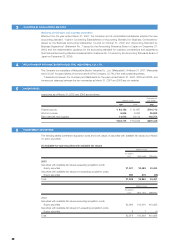

The Company provided allowance for employees’ severance and retirement benefits as of the balance sheet dates

based on the estimated amounts of projected benefit obligation and the fair value of plan assets at those dates.

The excess of the projected benefit obligation over the total of the fair value of plan assets as of April 1, 2000 and

the liabilities for severance and retirement benefits recorded as of April 1, 2000 (the “net transition obligation”) is rec-

ognized in expenses in equal amounts primarily over 15 years commencing with the year ended March 31, 2001.

Prior service costs are recognized in income or expenses using the straight-line method over 10 years, and

actuarial gains and losses are recognized in expenses using the straight-line method over 10 years commencing

with the succeeding period.

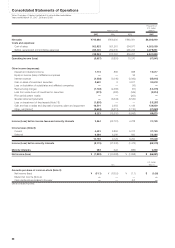

Amounts per share of common stock

The computation of net income per share is based on the weighted average number of shares of common stock

outstanding during each year.

Diluted net income per share assumes dilution that could occur if convertible bonds or similar securities were

converted into common stock resulting in the issuance of common stock. The Company did not have securities

that could potentially dilute net income per share in the year ended March 31, 2006 and 2007, and diluted net

income per share is not disclosed because there was a net loss in the year ended March 31, 2005.

Cash dividends per share represent the actual amount declared as applicable to the respective years.

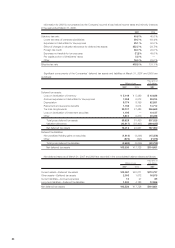

Impairment of fixed assets

In the fiscal year ended March 31, 2006, the Company and consolidated companies adopted the new accounting

standard for impairment of fixed assets (“Opinion Concerning Establishment of Accounting Standard for

Impairment of Fixed Assets” issued by the Business Accounting Deliberation Council on August 9, 2002) and the

implementation guidance for the accounting standard for impairment of fixed assets (the Financial Accounting

Standard Implementation Guidance No. 6 issued by the Accounting Standards Board of Japan on October 31,

2003).

Accounting Standard for Presentation of Net Assets in the Balance Sheet

Effective from the year ended March 31, 2007, the Company and its consolidated subsidiaries adopted the new

accounting standard, “Accounting Standard for Presentation of Net Assets in the Balance Sheet” (Statement No. 5

issued by the Accounting Standards Board of Japan on December 9, 2005), and the implementation guidance for

the accounting standard for presentation of net assets in the balance sheet (the Financial Accounting Standard

Implementation Guidance No. 8 issued by the Accounting Standards Board of Japan on December 9, 2005), (col-

lectively, the “New Accounting Standards”).

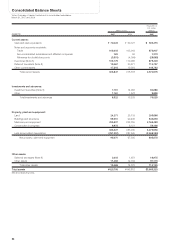

Under the New Accounting Standards, the balance sheet comprises three sections, which are the assets, liabili-

ties and net assets sections. Previously, the balance sheet comprised the assets, liabilities, minority interests, as

applicable, and the shareholders’ equity sections.

The consolidated balance sheet as of March 31, 2006 has been restated to conform to the 2007 presentation.

There were no effects on total assets or total liabilities from applying the New Accounting Standards to the balance

sheet as of March 31, 2006.

The adoption of the New Accounting Standards had no impact on the consolidated statements of income for

the years ended March 31, 2007 and 2006.

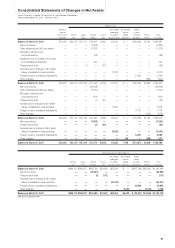

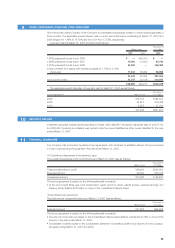

Accounting Standard for Statement of Changes in Net Assets

Effective from the year ended March 31, 2007, the Company and its consolidated subsidiaries adopted the new

accounting standard, “Accounting Standard for Statement of Changes in Net Assets” (Statement No. 6 issued by

the Accounting Standards Board of Japan on December 27, 2005), and the implementation guidance for the

accounting standard for statement of changes in net assets (the Financial Accounting Standard Implementation

Guidance No. 9 issued by the Accounting Standards Board of Japan on December 27, 2005), (collectively, the

“Additional New Accounting Standards”).

Accordingly, the Company prepared the statements of changes in net assets for the year ended March 31,

2007 in accordance with the Additional New Accounting Standards. Also, the Company voluntarily prepared the

consolidated statement of changes in net assets for 2006 in accordance with the Additional New Accounting

Standards. Previously, consolidated statements of shareholders’ equity were prepared for the purpose of inclusion

in the consolidated financial statements although such statements were not required under Japanese GAAP.

Reclassification and restatement

Certain prior year amounts have been reclassified to conform to the current year presentation.

Also, the consolidated balance sheet for 2006 has been adapted to conform to new presentation rules of 2007.

Furthermore, the consolidated statements of shareholders’ equity for the years ended March 31, 2006 and 2005 have

been modified to the forms of the consolidated statement of changes in net assets for 2007.