JVC 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

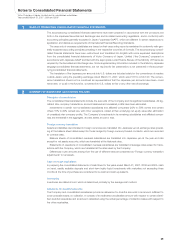

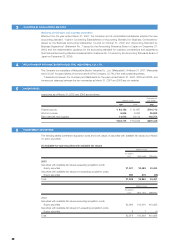

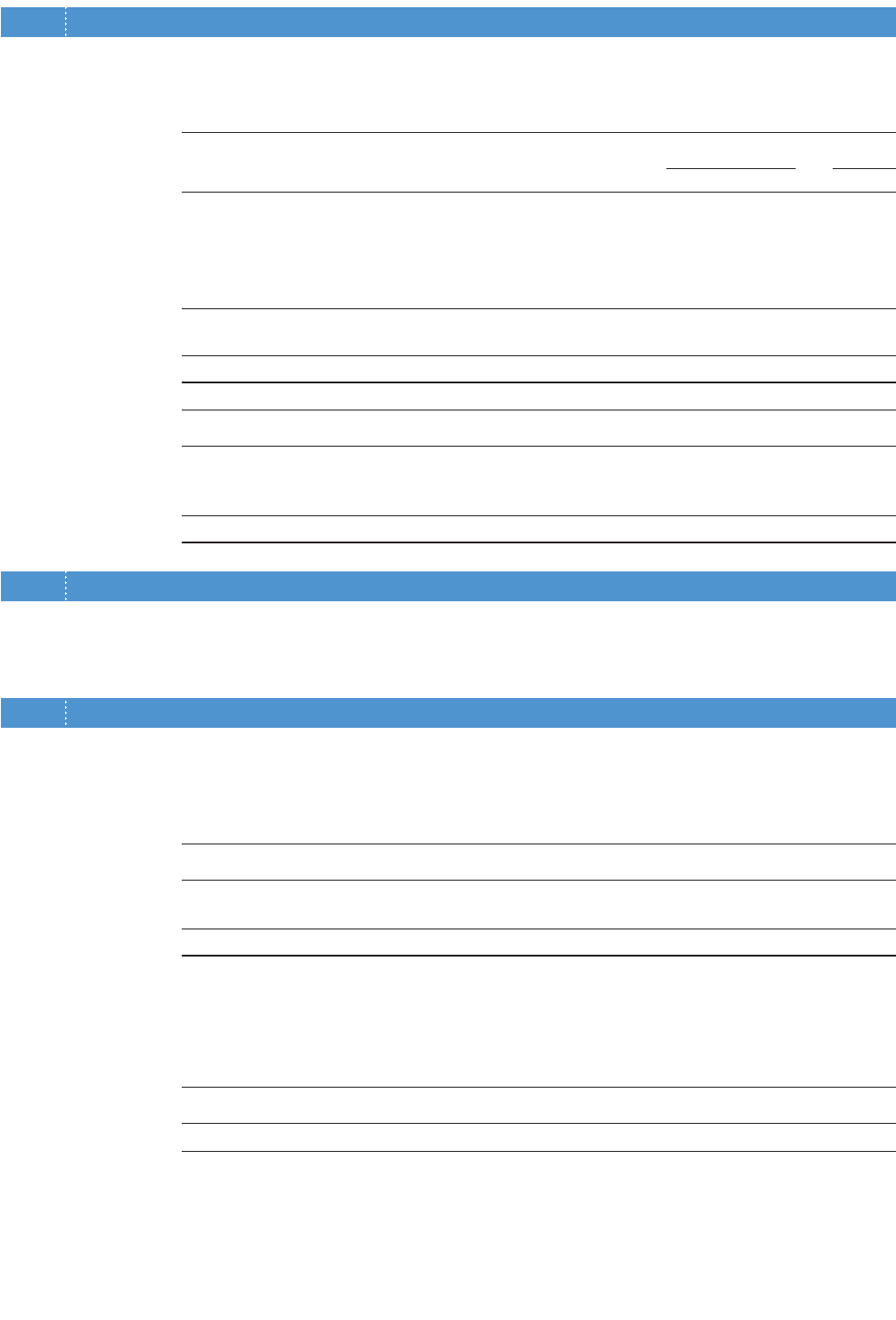

9SHORT-TERM BANK LOANS AND LONG-TERM DEBT

Short-term bank loans of certain of the Company’s consolidated subsidiaries consist of notes maturing generally in

three months. The applicable annual interest rates on short-term bank loans outstanding at March 31, 2007 and

2006 range from 1.68% to 16.70% and from 0.01% to 17.35%, respectively.

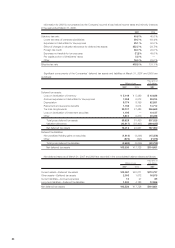

Long-term debt at March 31, 2007 and 2006 is as follows:

Thousands of

Millions of yen U.S. dollars

2007 2006 2007

1.68% unsecured bonds due in 2006 ¥—¥20,000 $—

1.89% unsecured bonds due in 2007 10,000 10,000 84,746

2.00% unsecured bonds due in 2009 20,000 —169,492

Loans, primarily from banks with interest principally at 1.70% to 6.10%

Unsecured 11,442 30,354 96,966

41,442 60,354 351,204

Less current portion 14,747 20,139 124,975

¥26,695 ¥40,215 $226,229

The aggregate annual maturities of long-term debt at March 31, 2007 are as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2008 ¥14,747 $124,975

2009 24,670 209,068

2010 2,025 17,161

¥41,442 $351,204

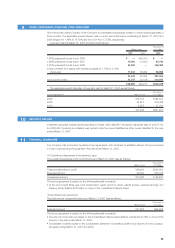

10 SECURITY DEPOSIT

Investment securities include loaned securities of ¥4,824 million ($40,881 thousand); deposited cash of ¥3,617 mil-

lion ($30,653 thousand) as collateral was posted under the current liabilities as other current liabilities for the year

ended March 31, 2007.

11 FINANCIAL COVENANTS

The Company has concluded syndicated loan agreements with its banks to establish efficient fund procurement

in order to secure its working capital in the year ended March 31, 2007.

(1) Commitment Agreement of Syndicated Loans

The outstanding balance of the commitment as of March 31, 2007 was as follows:

Thousands of

Millions of yen U.S. dollars

Total committed line of credit ¥39,600 $335,593

Executed amount ¥29,520 250,169

Unexecuted amount ¥10,080 $085,424

The above agreement is subject to the following financial covenants.

• At the end of each fiscal year, total stockholders’ equity (common stock, capital surplus, retained earnings, and

treasury stock) shall be ¥120 billion or more on the consolidated balance sheet.

(2) Syndicated loan agreement

The total amount of executed loans as of March 31, 2007 was as follows:

Thousands of

Millions of yen U.S. dollars

Executed amount ¥11,205 $94,958

The above agreement is subject to the following financial covenants.

• The amount of the total net assets on the consolidated balance sheet shall be maintained at 75% or more of the

amount in the year ended March 31, 2006.

• Consolidated ordinary losses on the consolidated statement of operations shall not be reported for two consecu-

tive years ending March 31, 2007 and 2008.

45