JVC 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

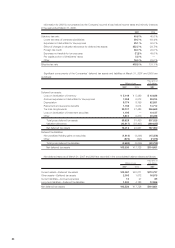

18 IMPAIRMENT OF FIXED ASSETS

During the fiscal year ended March 31, 2007, the Companies recognized loss on impairment totaling ¥1,805 million

($15,297 thousand) on the following fixed assets.

Thousands of

Location Use Type of assets Millions of yen U.S. dollars

Yokohama (Kanagawa) Idle properties Die and molds, machinery and

equipment and others ¥519 $4,398

Yokosuka (Kanagawa) Idle properties Tools, furniture and fixtures,

die and molds and others 231 1,958

San Diego, Assets used Die and molds, machinery and

California (USA) for business equipment and others 855 7,246

Tijuana (Mexico) Assets used Buildings, land and others

for business 200 1,695

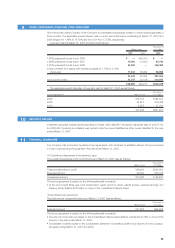

(Grouping method)

For assets used for business, grouping is based on the business segmentation, while considering the management

control unit, and for idle properties, each property is considered to constitute a group.

Headquarters were classified as corporate assets because they do not generate cash flows independent of

other assets or group of assets.

In addition, asset grouping is principally based on the accounting unit for the consolidated companies.

(History of recognition of impairment loss)

Idle properties were recognized as loss on impairment due to reduction of the DVD business. Assets used for busi-

ness were recognized as loss on impairment owing to decrease in estimated future cash flows caused by reducing

of working levels.

(Calculation method of carrying amounts)

For idle properties, with its unrecoverability, entire carrying amounts were reduced and the amounts were recorded

as loss on impairment. And for assets used for business, difference between their carrying amounts and appraisal

value prepared by real estate appraisers were recorded as loss on impairment.