JVC 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

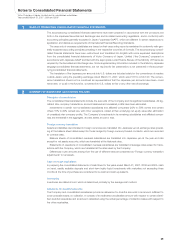

12 EMPLOYEES’ SEVERANCE AND RETIREMENT BENEFITS

Employees of Japanese companies are compulsorily included in the Welfare Pension Insurance Scheme enacted by

the national government. Employers are legally required to deduct employees’ welfare pension insurance contribu-

tions from their payroll and to pay them to the government together with employers’ own contributions. For compa-

nies that have established their own Employees’ Pension Fund which meets certain legal requirements, it is possible

to transfer a part of their welfare pension insurance contributions (referred to as the substitutional portion of the gov-

ernment’s scheme) to their own Employees’ Pension Fund under the government’s permission and supervision.

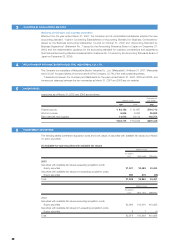

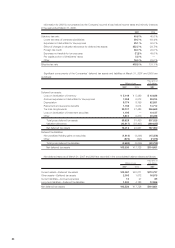

Obligation for employees’ retirement benefits included in liabilities in the consolidated balance sheets for 2007 and

2006 and the related expenses for 2007, 2006 and 2005, which were determined based on the amounts obtained

by actuarial calculations, are as follows:

Thousands of

Millions of yen U.S. dollars

2007 2006 2007

Projected benefit obligation:

Projected benefit obligation ¥(127,320) ¥(129,213) $(1,078,983)

Unamortized prior service costs (14,104) (15,985) (119,526)

Unamortized actuarial differences 4,757 6,693 40,314

Less fair value of plan assets 116,158 111,471 984,390

Less unrecognized net transition obligation 12,825 14,428 108,686

Liability for severance and retirement benefits ¥00(7,684) ¥0(12,606) $0,0(65,119)

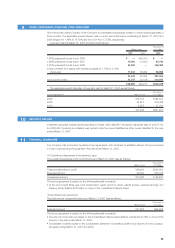

Thousands of

Millions of yen U.S. dollars

2007 2006 2005 2007

Severance and retirement benefits expenses:

Service costs ¥4,989 ¥4,845 ¥05,581 $42,279

Interest costs on projected benefit obligation 3,356 3,490 3,774 28,441

Expected return on plan assets (6,101) (2,426) (2,348) (51,703)

Amortization of net transition obligation 1,603 1,588 1,598 13,585

Amortization of actuarial differences 2,213 3,335 3,608 18,754

Amortization of prior service costs (1,881) (1,881) (940) (15,941)

Total ¥4,179 ¥8,951 ¥11,273 $35,415

The special retirement payments amounting to ¥6,544 million and ¥6,530 million which were expensed in 2006 and 2005,

respectively, are not included in the above table.

The discount rate and the rate of expected return on plan assets used by the Company are 2.7% and 5.5% in

2007, and 2.7% and 3.0% in 2006 and 2005, respectively.

The estimated amount of all retirement benefits to be paid at the future retirement dates is allocated equally to

each service year using the estimated number of total service years.

13 CONTINGENT LIABILITIES

The contingent liabilities of the Companies at March 31, 2007 are as follows:

Thousands of

Millions of yen U.S. dollars

As endorser of export bills discounted with banks ¥0,407 $03,449

As guarantor for loans to employees 1,660 14,068

¥2,067 $17,517