JVC 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

year-earlier level. In the United States, while HDD cam-

corder sales were brisk, sagging sales of D-ILA hybrid pro-

jection TVs and audio products, coupled with the shrinking

market for CRT TVs, caused overall segment sales in the

United States to contract compared with the prior-year

level. In Europe, despite brisk sales of HDD camcorders

and LCD TVs, total segment sales in the region were down

compared with the level of the previous year, reflecting a

falloff in sales of DVD recorders, a product category where

the lineup was cut back, weak sales of audio products, and

a downturn in CRT TV sales. In Asia excluding Japan, total

segment sales also dropped as an increase in HDD cam-

corder sales and a sharp expansion in LCD TV sales did not

fully counter slumping sales of CRT TVs and audio products.

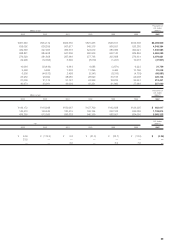

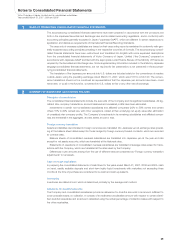

Professional Electronics

Sales decreased 5.3%, to ¥64.0 billion, but operating

income increased ¥300 million, to ¥1.0 billion. Overseas

sales of high-definition video camera recorders targeted at

professional users and security-related equipment were

robust, but segment sales declined due to sluggish domes-

tic sales of commercial-use audio equipment.

Components & Devices

Segment sales rose 17.7%, to ¥35.6 billion, and the seg-

ment posted an operating loss of ¥1.0 billion, a ¥1.1 billion

turnaround compared with operating income of ¥0.1 billion

in the prior fiscal year. Higher segment sales reflected

growth in sales of hard disk drive motors and optical pick-

ups used in vehicles.

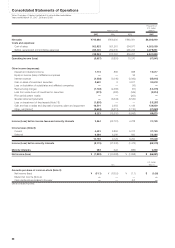

aforementioned negative factors. Consequently, the

Company recorded an operating loss of ¥5.7 billion in the

fiscal year under review, for a ¥1.2 billion improvement from

the ¥6.9 billion operating loss a year earlier.

As for other income (expenses), the Company booked

¥1.7 billion in restructuring charges associated with overseas

subsidiaries, ¥4.2 billion in interest expense, and ¥1.8 billion

in expenses for asset write-offs. Income before income taxes

and minority interests was ¥2.6 billion, which represents

a¥24.7 billion improvement from the prior fiscal year.

Reflecting higher corporate, inhabitant, and enterprise

taxes as well as the reevaluation of deferred tax assets and

other factors, income taxes amounted to ¥10.7 billion, and

the Company recorded a net loss of ¥7.9 billion for the fis-

cal year under review, compared with a net loss of ¥30.6

billion in fiscal 2006.

In view of this weak performance in fiscal 2007, the

Company has regretfully decided to temporarily suspend

the distribution of cash dividends.

Consumer Electronics

Sales in this segment fell 9.5%, to ¥543.3 billion, and the

segment posted an operating loss of ¥3.4 billion, which is a

¥6.2 billion improvement from the year earlier. In Japan, the

Company’s share of the camcorder market increased, and

its camcorder sales grew thanks to its hard disk camcorder

models, but the whittling back of the DVD recorder lineup

led to lower sales in this category, and sales of audio prod-

ucts and LCD TVs also declined. Consequently, total

domestic segment sales were down compared with the

SEGMENT INFORMATION