JVC 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

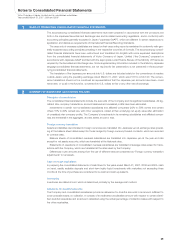

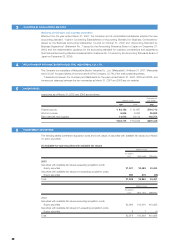

Information for 2006 is not prepared as the Company incurred a loss before income taxes and minority interests

in the year ended March 31, 2006.

2007 2005

Statutory tax rate: 40.6)%40.6)%

Lower tax rates of overseas subsidiaries 39.5)%(19.4)%

Expenses not deductible for tax purposes 25.1)%50.0)%

Effect of changes in valuation allowance for deferred tax assets 252.5)%(34.7)%

Foreign tax credit 46.0)%22.0)%

Expenses not taxable for tax purposes (7.2)% 49.6)%

Per capita portion of inhabitants’ taxes 5.8)%—)%

Other 16.5)%23.0)%

Effective tax rate 418.8)%131.1)%

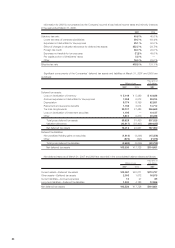

Significant components of the Companies’ deferred tax assets and liabilities at March 31, 2007 and 2006 are

as follows:

Thousands of

Millions of yen U.S. dollars

2007 2006 2007

Deferred tax assets:

Loss on devaluation of inventory ¥05,149 ¥05,389 $43,636

Accrued expenses not deductible for tax purposes 7,058 6,572 59,814

Depreciation 9,774 8,799 82,831

Retirement and severance benefits 1,736 3,914 14,712

Tax loss carryforwards 29,107 27,486 246,669

Loss on devaluation of investment securities 1,195 —10,127

Other 5,810 9,270 49,236

Total gross deferred tax assets 59,829 61,430 507,025

Valuation allowance (43,617) (38,463) (369,635)

Net deferred tax assets 16,212 22,967 137,390

Deferred tax liabilities:

Net unrealized holding gains on securities (1,812) (4,246) (15,356)

Other (870) (993) (7,373)

Total gross deferred tax liabilities (2,682) (5,239) (22,729)

Net deferred tax assets ¥13,530 ¥17,728 $114,661

Net deferred taxes as of March 31, 2007 and 2006 are recorded in the consolidated balance sheets as follows:

Thousands of

Millions of yen U.S. dollars

2007 2006 2007

Current assets—Deferred tax assets ¥13,067 ¥20,271 $110,737

Other assets—Deffered tax assets 2,003 1,672 16,975

Current liabilities—Accrued expenses 10 27 85

Long-term liabilities—Deferred tax liabilities 1,530 4,188 12,966

Net deferred tax assets ¥13,530 ¥17,728 $114,661

44