Hasbro 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

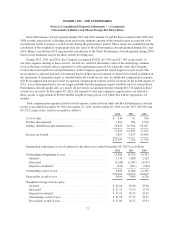

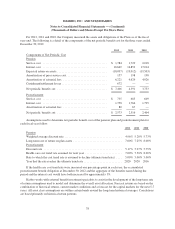

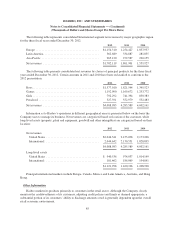

At December 30, 2012 and December 25, 2011, the fair value of the Company’s undesignated derivative

financial instruments are recorded in the consolidated balance sheet as follows:

2012 2011

Accrued liabilities

Unrealized gains ............................................................... $469 41

Unrealized losses ............................................................... (796) (786)

Net unrealized loss .............................................................. (327) (745)

Other liabilities

Unrealized gains ............................................................... — —

Unrealized losses ............................................................... — (1,104)

Net unrealized loss .............................................................. — (1,104)

Total unrealized loss, net ......................................................... $(327) (1,849)

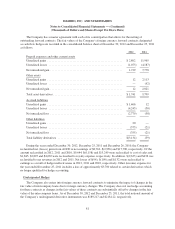

The Company recorded net losses (gains) of $2,067, $(9,098) and $(4,827) on these instruments to other

(income) expense, net for 2012, 2011 and 2010, respectively, relating to the change in fair value of such

derivatives, substantially offsetting gains and losses from the change in fair value of intercompany loans to which

the instruments relate.

For additional information related to the Company’s derivative financial instruments see notes 2, 9 and 12.

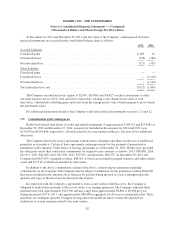

(17) Commitments and Contingencies

Hasbro had unused open letters of credit and related instruments of approximately $194,221 and $174,082 at

December 30, 2012 and December 25, 2011, respectively. Included in the amounts for 2012 and 2011 were

$174,870 and $150,840, respectively, of bonds related to tax assessments in Mexico. See note 10 for additional

discussion.

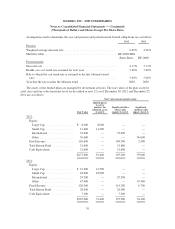

The Company enters into license agreements with inventors, designers and others for the use of intellectual

properties in its products. Certain of these agreements contain provisions for the payment of guaranteed or

minimum royalty amounts. Under terms of existing agreements as of December 30, 2012, Hasbro may, provided

the other party meets their contractual commitment, be required to pay amounts as follows: 2013: $98,888; 2014:

$21,917; 2015: $20,660; 2016: $19,550; 2017: $19,525; and thereafter: $46,275. At December 30, 2012, the

Company had $163,875 of prepaid royalties, $86,361 of which are included in prepaid expenses and other current

assets and $77,514 of which are included in other assets.

In addition to the above commitments, certain of the above contracts impose minimum marketing

commitments on the Company. The Company may be subject to additional royalty guarantees totaling $140,000

that are not included in the amounts above that may be payable during the next six years contingent upon the

quantity and types of theatrical movie releases by the licensor.

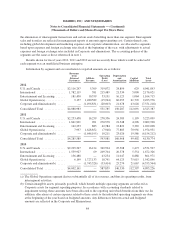

In connection with the Company’s agreement to form a joint venture with Discovery, the Company is

obligated to make future payments to Discovery under a tax sharing agreement. The Company estimates these

payments may total approximately $123,300 and may range from approximately $6,800 to $8,000 per year

during the period 2013 to 2017, and approximately $86,400 in aggregate for all years occurring thereafter. These

payments are contingent upon the Company having sufficient taxable income to realize the expected tax

deductions of certain amounts related to the joint venture.

82