Hasbro 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

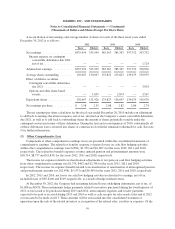

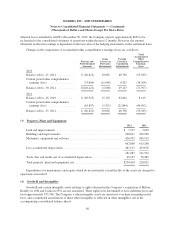

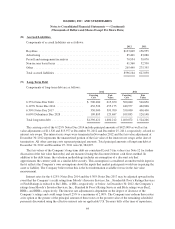

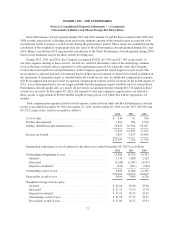

A reconciliation of the statutory United States federal income tax rate to Hasbro’s effective income tax rate

is as follows:

2012 2011 2010

Statutory income tax rate .......................................... 35.0% 35.0% 35.0%

State and local income taxes, net .................................... 0.3 0.3 0.4

Tax on international earnings ...................................... (9.4) (11.4) (11.2)

Exam settlements and statute expirations ............................. (0.7) (4.6) (4.4)

Other, net ...................................................... 0.7 1.5 1.9

25.9% 20.8% 21.7%

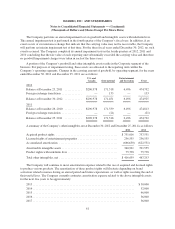

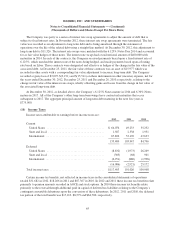

The components of earnings before income taxes, determined by tax jurisdiction, are as follows:

2012 2011 2010

United States .......................................... $113,893 132,255 168,436

International ........................................... 339,509 354,138 339,284

Total earnings before income taxes ......................... $453,402 486,393 507,720

The components of deferred income tax expense (benefit) arise from various temporary differences and

relate to items included in the consolidated statements of operations as well as items recognized in other

comprehensive earnings. The tax effects of temporary differences that give rise to significant portions of the

deferred tax assets and liabilities at December 30, 2012 and December 25, 2011 are:

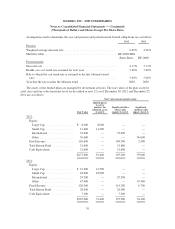

2012 2011

Deferred tax assets:

Accounts receivable ............................................ $ 21,410 22,007

Inventories ................................................... 15,472 18,398

Loss carryforwards ............................................. 25,083 27,943

Operating expenses ............................................ 46,879 39,623

Pension ...................................................... 49,159 35,969

Other compensation ............................................ 53,611 49,780

Postretirement benefits .......................................... 16,447 15,723

Tax sharing agreement .......................................... 25,510 25,991

Other ........................................................ 31,038 17,749

Gross deferred tax assets ...................................... 284,609 253,183

Valuation allowance ............................................ (17,145) (18,145)

Net deferred tax assets ........................................ 267,464 235,038

Deferred tax liabilities:

International earnings not indefinitely reinvested ..................... 1,919 7,846

Depreciation and amortization of long-lived assets .................... 76,365 73,301

Equity method investment ....................................... 19,967 21,396

Other ........................................................ 5,736 3,075

Deferred tax liabilities ........................................ 103,987 105,618

Net deferred income taxes ......................................... $163,477 129,420

66