Hasbro 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

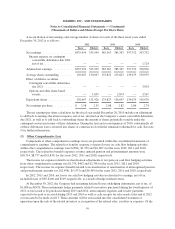

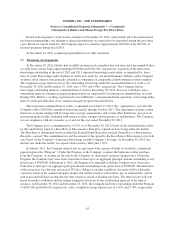

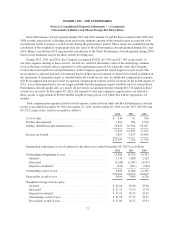

(5) Equity Method Investment

The Company owns a 50% interest in a joint venture, Hub Television Networks, LLC (“THE HUB”), with

Discovery Communications, Inc. (“Discovery”). THE HUB was established to create a television network in the

United States dedicated to high-quality children’s and family entertainment and educational programming. The

Company purchased its 50% share in THE HUB for a payment of $300,000 and certain future payments based on

the value of certain tax benefits expected to be received by the Company. The present value of the expected

future payments at the acquisition date totaled approximately $67,900 and was recorded as a component of the

Company’s investment in the joint venture. The balance of the associated liability, including imputed interest,

was $71,072 and $71,999 at December 30, 2012 and December 25, 2011, respectively, and is included as a

component of other liabilities in the accompanying balance sheets.

Voting control of THE HUB is shared 50/50 between the Company and Discovery. The Company has

determined that it does not meet the control requirements to consolidate THE HUB, and accounts for the

investment using the equity method of accounting. The Company’s share in the loss of THE HUB for the years

ended December 30, 2012, December 25, 2011 and December 26, 2010 totaled $6,015, $7,290 and $9,323,

respectively, and is included as a component of other (income) expense, net in the accompanying consolidated

statements of operations.

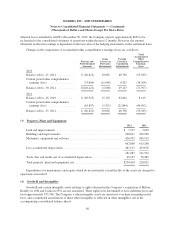

The Company has entered into a license agreement with THE HUB that requires the payment of royalties by

the Company to THE HUB based on a percentage of revenue derived from products related to television shows

broadcast by the joint venture. The license agreement includes a minimum royalty guarantee of $125,000,

payable in 5 annual installments of $25,000 per year, commencing in 2009, which can be earned out over

approximately a 10-year period. During 2012, 2011 and 2010, the Company paid annual installments of $25,000

each which are included in other, including long-term advances in the consolidated statements of cash flows. As

of December 30, 2012 and December 25, 2011, the Company had $89,914 and $72,916 of prepaid royalties,

respectively, related to this agreement, $12,400 and $4,974, respectively, of which are included in prepaid

expenses and other current assets and $77,514 and $67,942, respectively, of which are included in other assets.

The Company and THE HUB are also parties to an agreement under which the Company will provide THE HUB

with an exclusive first look in the U.S. to license certain types of programming developed by the Company based

on its intellectual property. In the event THE HUB licenses the programming from the Company to air on the

network, it is required to pay the Company a license fee.

As of December 30, 2012 and December 25, 2011, the Company’s interest in THE HUB totaled $330,746

and $343,835, respectively, and is a component of other assets. The Company also enters into certain other

transactions with THE HUB including the licensing of television programming and the purchase of advertising.

During 2012, 2011 and 2010, these transactions were not material.

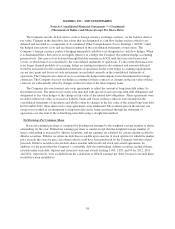

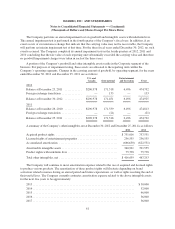

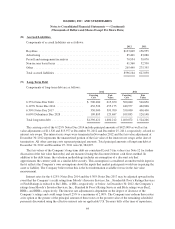

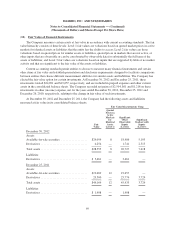

(6) Program Production Costs

Program production costs are included in other assets and consist of the following at December 30, 2012

and December 25, 2011:

2012 2011

Released, less amortization ........................................... $65,201 44,091

In production ...................................................... 22,909 33,583

Pre-production ..................................................... 3,865 2,161

Acquired libraries .................................................. — 765

Total program production costs ....................................... $91,975 80,600

62