Hasbro 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

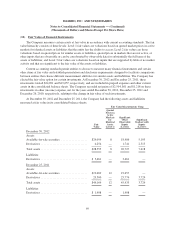

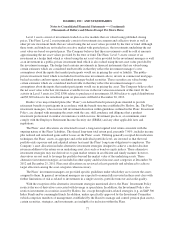

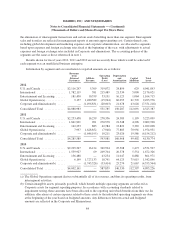

Expected benefit payments under the defined benefit pension plans and the postretirement benefit plan for

the next five years subsequent to 2012 and in the aggregate for the following five years are as follows:

Pension Postretirement

2013 ....................................................... $ 20,864 2,141

2014 ....................................................... 21,164 1,952

2015 ....................................................... 21,509 1,945

2016 ....................................................... 21,688 1,965

2017 ....................................................... 22,556 1,920

2018-2022 .................................................. 118,965 9,459

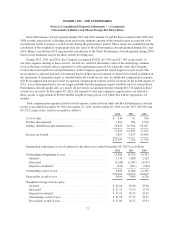

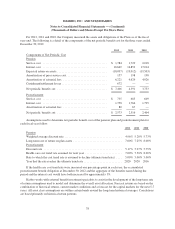

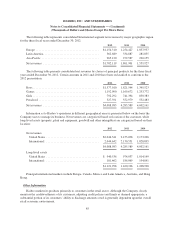

International Plans

Pension coverage for employees of Hasbro’s international subsidiaries is provided, to the extent deemed

appropriate, through separate defined benefit and defined contribution plans. At December 30, 2012 and

December 25, 2011, the defined benefit plans had total projected benefit obligations of $107,366 and $82,904,

respectively, and fair values of plan assets of $76,930 and $68,430, respectively. Substantially all of the plan

assets are invested in equity and fixed income securities. The pension expense related to these plans was $3,458,

$2,758 and $2,333 in 2012, 2011 and 2010, respectively. In fiscal 2013, the Company expects amortization of $3

of prior service costs, $1,614 of unrecognized net losses and $4 of unrecognized transition obligation to be

included as a component of net periodic benefit cost.

Expected benefit payments under the international defined benefit pension plans for the five years

subsequent to 2012 and in the aggregate for the five years thereafter are as follows: 2013: $1,874; 2014: $2,068;

2015: $2,248; 2016: $2,400; 2017: $2,674; and 2018 through 2022: $16,703.

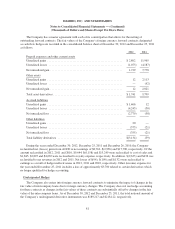

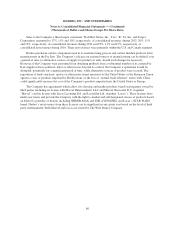

Postemployment Benefits

Hasbro has several plans covering certain groups of employees, which may provide benefits to such

employees following their period of active employment but prior to their retirement. These plans include certain

severance plans which provide benefits to employees involuntarily terminated and certain plans which continue

the Company’s health and life insurance contributions for employees who have left Hasbro’s employ under terms

of its long-term disability plan.

(15) Leases

Hasbro occupies offices and uses certain equipment under various operating lease arrangements. The rent

expense under such arrangements, net of sublease income which is not material, for 2012, 2011 and 2010

amounted to $46,636, $47,437 and $41,911, respectively.

Minimum rentals, net of minimum sublease income, which is not material, under long-term operating leases

for the five years subsequent to 2012 and in the aggregate thereafter are as follows: 2013: $39,688; 2014:

$26,161; 2015: $13,249; 2016: $7,207; 2017: $4,677; and thereafter: $13,686.

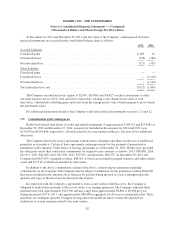

All leases expire prior to the end of 2024. Real estate taxes, insurance and maintenance expenses are

generally obligations of the Company. It is expected that, in the normal course of business, leases that expire will

be renewed or replaced by leases on other properties; thus, it is anticipated that future minimum lease

commitments will not be less than the amounts shown for 2012.

79