Hasbro 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

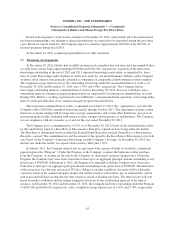

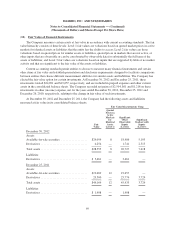

The Company was party to a series of interest rate swap agreements to adjust the amount of debt that is

subject to fixed interest rates. In November 2012, these interest rate swap agreements were terminated. The fair

value was recorded as an adjustment to long-term debt and is being amortized through the statement of

operations over the life of the related debt using a straight-line method. At December 30, 2012, this adjustment to

long-term debt is $11,526. The interest rate swaps were matched with the 6.125% Notes Due 2014 and accounted

for as fair value hedges of those notes. The interest rate swaps had a total notional amount of $400,000 with

maturities in 2014. In each of the contracts, the Company received payments based upon a fixed interest rate of

6.125%, which matched the interest rate of the notes being hedged, and made payments based upon a floating

rate based on Libor. These contracts were designated and effective as hedges of the change in the fair value of the

associated debt. At December 25, 2011, the fair value of these contracts was an asset of $15,977 which was

recorded in other assets with a corresponding fair value adjustment to increase long-term debt. The Company

recorded a (gain) loss of $3,095, $(3,191) and $(15,511) on these instruments in other (income) expense, net for

the years ended December 30, 2012, December 25, 2011 and December 26, 2010, respectively, relating to the

change in fair value of the interest rate swaps, wholly offsetting gains and losses from the change in fair value of

the associated long-term debt.

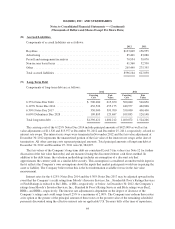

At December 30, 2012, as detailed above, the Company’s 6.125% Notes mature in 2014 and 6.30% Notes

mature in 2017. All of the Company’s other long-term borrowings have contractual maturities that occur

subsequent to 2017. The aggregate principal amount of long-term debt maturing in the next five years is

$775,000.

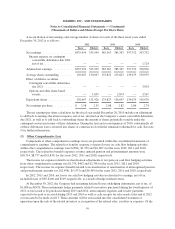

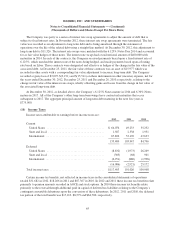

(10) Income Taxes

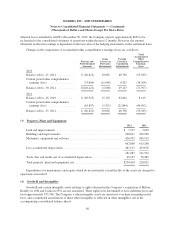

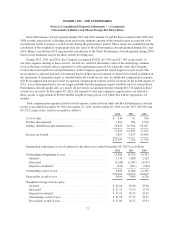

Income taxes attributable to earnings before income taxes are:

2012 2011 2010

Current

United States ....................................... $ 64,076 49,233 35,232

State and local ...................................... 1,587 2,538 1,931

International ........................................ 67,826 52,176 47,633

133,489 103,947 84,796

Deferred

United States ....................................... (8,832) (1,973) 26,269

State and local ...................................... (303) (68) 901

International ........................................ (6,951) (880) (1,998)

(16,086) (2,921) 25,172

Total income taxes ..................................... $117,403 101,026 109,968

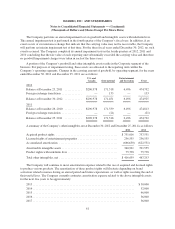

Certain income tax benefits, not reflected in income taxes in the consolidated statements of operations

totaled $31,682 in 2012, $18,266 in 2011 and $87,367 in 2010. In 2012 and 2011 these income tax benefits relate

primarily to pension amounts recorded in AOCE and stock options. In 2010 these income tax benefits relate

primarily to the reversal through additional paid in capital of deferred tax liabilities relating to the Company’s

contingent convertible debentures upon the conversion of these debentures. In 2012, 2011 and 2010, the deferred

tax portion of the total benefit was $17,213, $8,579 and $64,700, respectively.

65