Hasbro 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

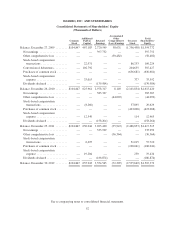

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

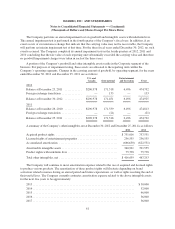

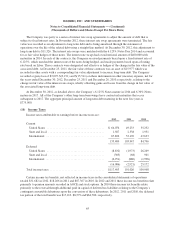

The Company records all derivatives, such as foreign currency exchange contracts, on the balance sheet at

fair value. Changes in the derivative fair values that are designated as cash flow hedges and are effective are

deferred and recorded as a component of Accumulated Other Comprehensive (Loss) Earnings (“AOCE”) until

the hedged transactions occur and are then recognized in the consolidated statements of operations. The

Company’s foreign currency contracts hedging anticipated cash flows are designated as cash flow hedges. When

it is determined that a derivative is not highly effective as a hedge, the Company discontinues hedge accounting

prospectively. Any gain or loss deferred through that date remains in AOCE until the forecasted transaction

occurs, at which time it is reclassified to the consolidated statements of operations. To the extent the transaction

is no longer deemed probable of occurring, hedge accounting treatment is discontinued and amounts deferred

would be reclassified to the consolidated statements of operations. In the event hedge accounting requirements

are not met, gains and losses on such instruments are included currently in the consolidated statements of

operations. The Company uses derivatives to economically hedge intercompany loans denominated in foreign

currencies. The Company does not use hedge accounting for these contracts as changes in the fair value of these

contracts are substantially offset by changes in the fair value of the intercompany loans.

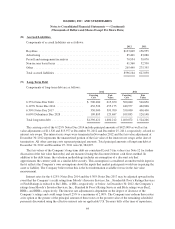

The Company also used interest rate swap agreements to adjust the amount of long-term debt subject to

fixed interest rates. The interest rate swaps were matched with specific fixed rate long-term debt obligations and

designated as fair value hedges of the change in fair value of the related debt obligations. These agreements were

recorded at their fair value as an asset or liability. Gains and losses on these contracts were included in the

consolidated statements of operations and wholly offset by changes in the fair value of the related long-term debt.

In November 2012, these interest rate swap agreements were terminated. The realized gain on the interest rate

swaps was recorded as an adjustment to long-term debt and is being amortized through the statement of

operations over the term of the related long-term debt using a straight-line method.

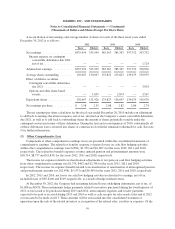

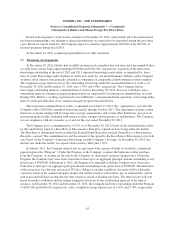

Net Earnings Per Common Share

Basic net earnings per share is computed by dividing net earnings by the weighted average number of shares

outstanding for the year. Diluted net earnings per share is similar except that the weighted average number of

shares outstanding is increased by dilutive securities, and net earnings are adjusted for certain amounts related to

dilutive securities. Dilutive securities include shares issuable upon exercise of stock options for which the market

price exceeds the exercise price, less shares which could have been purchased by the Company with the related

proceeds. Dilutive securities also include shares issuable under restricted stock unit award agreements. In

addition, for the period that the Company’s convertible debt was outstanding, dilutive securities included shares

issuable under such debt. Options and restricted stock unit awards totaling 3,409, 1,851 and 94 for 2012, 2011

and 2010, respectively, were excluded from the calculation of diluted earnings per share because to include them

would have been antidilutive.

58