Hasbro 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We begin 2013 in a strong position with good quality

inventory at Hasbro and our retail partners, as well as

compelling brand innovation.

This is despite not achieving

our objective of growing 2012 revenues absent the impact of

foreign exchange versus $4.29 billion in revenues in 2011.

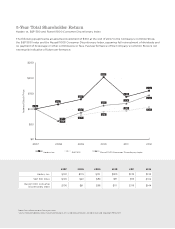

Generating, Investing and Returning Cash

Over the past five years, Hasbro has generated $2.2

billion in operating cash flow. We have used that cash to

strategically invest more than $400 million in expanding

our global footprint and capabilities across several long-

term growth opportunities, including the emerging markets,

entertainment - including Hasbro Studios - and licensing.

In 2009, we also invested $300 million in our joint

venture with Discovery Communications to establish THE

HUB kids’ television network in the U.S. In 2012, THE HUB

had a record year in terms of ratings and was the fastest

growing children’s cable network in both distribution and

ratings growth. This strategic investment was the catalyst

for launching Hasbro Studios and our global television

strategy. Today, we have Hasbro television programs airing

in more than 170 countries around the world.

During that five-year period, we have remained

committed to returning cash to you, our shareholders. We

have paid $731 million through our dividend program and

spent $1.6 billion in share repurchases.

In 2012, we generated $535 million in operating

cash flow, ahead of our $500 million annual target. Our

consistent cash generation continues to provide us with

capital to both strategically deploy back into our business

and return to you, our shareholders.

As a result, last year we were able to return $323.5

million dollars to shareholders. This included $225.5 million

through our quarterly dividend program, including $46.6

million dollars associated with the accelerated payment

of our historical February dividend, which we paid in

December 2012.

Importantly, in February 2013, we announced the ninth

increase of our dividend over the last ten years. The new

quarterly dividend rate is $0.40 per share, up 11%, or $0.04,

from the previous rate of $0.36 per share. Our ability to

increase the dividend continues to speak to the confidence

our Board of Directors has in the long-term opportunities

for our company.

During 2012, we also spent $100 million on share

repurchases, buying back 2.7 million shares at an average

price of $37.11.

Increasing Focus, Streamlining the Company

As we continue to accelerate the transformation of our

company while operating in markets with new consumer

and retail dynamics, we have outlined a company wide cost

savings initiative designed to deliver $100 million in annual

savings by 2015.

We are reviewing the organization from top to bottom

to identify cost-saving opportunities. To date, these include

an approximate 10% reduction in work force, including

an early retirement oering, facility consolidation, the

continuation of our item and SKU count reduction programs

and the implementation of process improvements. These

actions are global in nature and reach across multiple

disciplines and functions.

Our 2012 results include a pre-tax charge of $36 million

related to the initial implementation of this program and we

anticipate $20-$30 million in additional charges in 2013. We

expect to realize 2013 net savings of $15-$25 million with the

remainder of the savings being fully recognized by 2015 as

all aspects of the plan are implemented.

Over the past several years, we’ve invested in strategic

growth opportunities for Hasbro. We’ve added new brand-

building capabilities, while eliminating many historical

complex and costly SKU-making behaviors. We will continue

investing strategically for the long-term where we anticipate

strong returns on that investment, but we are accelerating

our cost-saving eorts to reflect the market environment

and our strategic decision to focus on fewer, more

significant initiatives. Our objective remains to help ensure

that, in any environment, we continue to enhance our total

shareholder returns, while delivering great innovation and

play experiences to our global customers and consumers.

Building Global Brands

Innovation, entertainment, digital engagement, engaging

storytelling and global consumer insights are at the

center of our brand initiatives year in and year out.

In 2012, the combination of these elements of our

blueprint enabled several brands to stand out.

As one of our franchise brands, MY LITTLE PONY

continued on its growth trajectory last year. With the

support of global television, product innovation, inventive

licensing, a new digital app game, online experiences and

a strong retail execution, MY LITTLE PONY posted very

robust, double-digit growth year-over-year. In 2013, the

magical storytelling behind our global animation will focus

on an all-new theme and we will unveil an entirely new

intellectual property based on the brand.