Hasbro 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 the Company’s Board increased the Company’s quarterly dividend rate, effective for the dividend payment

in May 2013, to $0.40 per share, an 11% increase from the prior year quarterly dividend of $0.36 per share. This

was the ninth dividend increase in the previous 10 years. During that period, the Company has increased its

quarterly cash dividend from $0.03 to $0.40 per share.

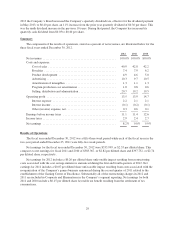

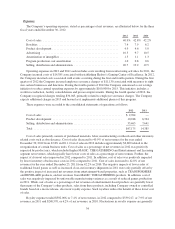

Summary

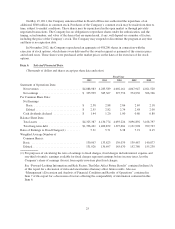

The components of the results of operations, stated as a percent of net revenues, are illustrated below for the

three fiscal years ended December 30, 2012.

2012 2011 2010

Net revenues .................................................. 100.0% 100.0% 100.0%

Costs and expenses:

Cost of sales .............................................. 40.9 42.8 42.2

Royalties ................................................. 7.4 7.9 6.2

Product development ....................................... 4.9 4.6 5.0

Advertising ............................................... 10.3 9.7 10.5

Amortization of intangibles .................................. 1.3 1.1 1.3

Program production cost amortization .......................... 1.0 0.8 0.6

Selling, distribution and administration ......................... 20.7 19.2 19.5

Operating profit ............................................... 13.5 13.9 14.7

Interest expense ........................................... 2.2 2.1 2.1

Interest income ............................................ (0.1) (0.2) (0.1)

Other (income) expense, net .................................. 0.3 0.6 0.1

Earnings before income taxes .................................... 11.1 11.4 12.6

Income taxes .................................................. 2.9 2.4 2.7

Net earnings .................................................. 8.2% 9.0% 9.9%

Results of Operations

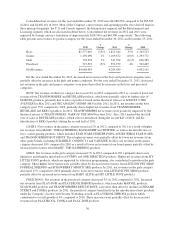

The fiscal year ended December 30, 2012 was a fifty-three week period while each of the fiscal years in the

two-year period ended December 25, 2011 were fifty-two week periods.

Net earnings for the fiscal year ended December 30, 2012 were $335,999, or $2.55 per diluted share. This

compares to net earnings for fiscal 2011 and 2010 of $385,367, or $2.82 per diluted share and $397,752, or $2.74

per diluted share, respectively.

Net earnings for 2012 includes a $0.26 per diluted share unfavorable impact resulting from restructuring

costs associated with the cost savings initiatives announced during the first and fourth quarters of 2012. Net

earnings for 2011 includes a $0.07 per diluted share unfavorable impact resulting from costs associated with the

reorganization of the Company’s games business announced during the second quarter of 2011 related to the

establishment of the Gaming Center of Excellence. Substantially all of the restructuring charges in 2012 and

2011 are included in Corporate and Eliminations in the Company’s segment reporting. Net earnings for both

2011 and 2010 include a $0.15 per diluted share favorable tax benefit resulting from the settlement of tax

examinations.

29