Hasbro 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

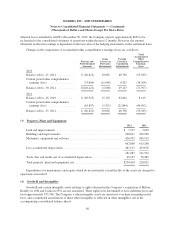

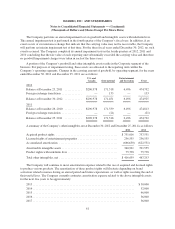

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

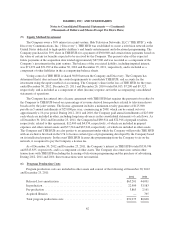

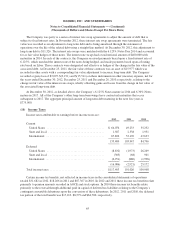

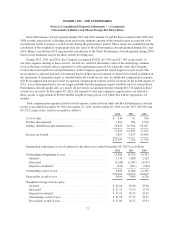

Based on management’s total revenue estimates at December 30, 2012, substantially all of the unamortized

television programming costs relating to released productions are expected to be amortized during the next three

years. Based on current estimates, the Company expects to amortize approximately $48,000 of the $65,201 of

released programs during fiscal 2013.

At December 30, 2012, acquired program libraries are fully amortized.

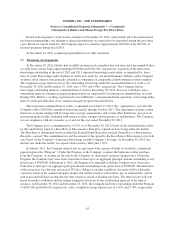

(7) Financing Arrangements

At December 30, 2012, Hasbro had available an unsecured committed line and unsecured uncommitted lines

of credit from various banks approximating $700,000 and $102,700, respectively. A portion of the short-term

borrowings outstanding at the end of 2012 and 2011 represent borrowings made under, or supported by, these

lines of credit. Borrowings under the lines of credit were made by certain international affiliates of the Company

on terms and at interest rates generally extended to companies of comparable creditworthiness in those markets.

The weighted average interest rates of the outstanding borrowings under the uncommitted lines of credit as of

December 30, 2012 and December 25, 2011 were 5.79% and 4.84%, respectively. The Company had no

borrowings outstanding under its committed line of credit at December 30, 2012; however, it did have notes

outstanding under its commercial paper program which are supported by its unsecured committed line of credit.

During 2012, Hasbro’s working capital needs were fulfilled by cash generated from operations, borrowings under

lines of credit and utilization of its commercial paper program discussed below.

The unsecured committed line of credit, as amended on October 25, 2012 (the “Agreement”), provides the

Company with a $700,000 committed borrowing facility through October 2017. The Agreement contains certain

financial covenants setting forth leverage and coverage requirements, and certain other limitations typical of an

investment grade facility, including with respect to liens, mergers and incurrence of indebtedness. The Company

was in compliance with all covenants as of and for the year ended December 30, 2012.

The Company pays a commitment fee (0.15% as of December 30, 2012) based on the unused portion of the

facility and interest equal to a Base Rate or Eurocurrency Rate plus a spread on borrowings under the facility.

The Base Rate is determined based on either the Federal Funds Rate plus a spread, Prime Rate or Eurocurrency

Rate plus a spread. The commitment fee and the amount of the spread to the Base Rate or Eurocurrency rate both

vary based on the Company’s long-term debt ratings and the Company’s leverage. At December 30, 2012, the

interest rate under the facility was equal to Eurocurrency Rate plus 1.25%.

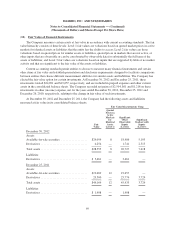

In January 2011, the Company entered into an agreement with a group of banks to establish a commercial

paper program (the “Program”). Under the Program, at the Company’s request the banks may either purchase

from the Company, or arrange for the sale by the Company of, unsecured commercial paper notes. Under the

Program, the Company may issue notes from time to time up to an aggregate principal amount outstanding at any

given time of $500,000. Subsequent to 2012, the Program was amended so that the Company may issue notes

from time to time up to an aggregate principal amount outstanding at any given time of $700,000. The maturities

of the notes may vary but may not exceed 397 days. Subject to market conditions, the notes will be sold under

customary terms in the commercial paper market and will be issued at a discount to par, or alternatively, will be

sold at par and will bear varying interest rates based on a fixed or floating rate basis. The interest rates will vary

based on market conditions and the ratings assigned to the notes by the credit rating agencies at the time of

issuance. At December 30, 2012 and December 25, 2011, the Company had notes outstanding under the Program

of $209,190 and $166,459, respectively, with a weighted average interest rate of 1.46% and 1.79%, respectively.

63