HSBC 2015 Annual Report Download - page 288

Download and view the complete annual report

Please find page 288 of the 2015 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440 -

441

441 -

442

442 -

443

443 -

444

444 -

445

445 -

446

446 -

447

447 -

448

448 -

449

449 -

450

450 -

451

451 -

452

452 -

453

453 -

454

454 -

455

455 -

456

456 -

457

457 -

458

458 -

459

459 -

460

460 -

461

461 -

462

462 -

463

463 -

464

464 -

465

465 -

466

466 -

467

467 -

468

468 -

469

469 -

470

470 -

471

471 -

472

472 -

473

473 -

474

474 -

475

475 -

476

476 -

477

477 -

478

478 -

479

479 -

480

480 -

481

481 -

482

482 -

483

483 -

484

484 -

485

485 -

486

486 -

487

487 -

488

488 -

489

489 -

490

490 -

491

491 -

492

492 -

493

493 -

494

494 -

495

495 -

496

496 -

497

497 -

498

498 -

499

499 -

500

500 -

501

501 -

502

502

|

|

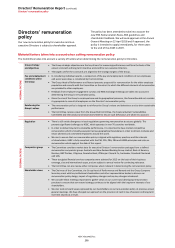

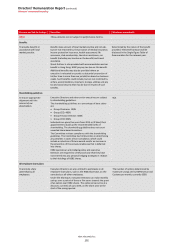

Directors’ Remuneration Report (continued)

Statement from Group Remuneration Committee Chairman

HSBC HOLDINGS PLC

286

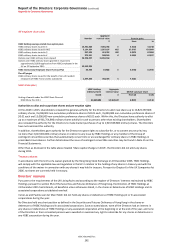

Overall performance summary/business context

We grew adjusted revenue, strengthened our capital position and increased our dividend payable to shareholders.

• Reported PBT for 2015 was up 1% at $18,867m compared with $18,680m for 2014.

• Adjusted PBT was down 7% for 2015 at $20,418m compared with $21,976m for 2014. Adjusted PBT was up in two of five regions.

• Adjusted revenue increased by $538m or 1% in 2015 to $57,765m compared with $57,227m for 2014, driven by revenue growth in client-

facing GB&M, principally in Equities and Foreign Exchange. Revenue also increased in CMB and Principal RBWM.

• Adjusted LICs increased by $553m or 17% to $3,721m compared with $3,168m in 2014. LICs increased in CMB and in RBWM.

• Adjusted operating expenses increased by $1,606m or 5% to $36,182m compared with $34,576m for 2014, reflecting investment in

growth, and regulatory programmes and compliance costs. Excluding the bank levy which is booked in the fourth quarter each year,

operating expenses in the second half of 2015 were broadly in line with the first half of the year. This was despite investment and

inflationary pressures, and partly reflects the initial effect of our cost saving initiatives and a strong focus on cost management.

• Dividends in respect of 2015 increased from $0.50 per ordinary share in 2014 to $0.51 per ordinary share.

• Our CRD IV end point CET1 capital ratio of 11.9% at 31 December 2015 was up from 11.1% at 31 December 2014. We continue to

generate capital from profit and our progress to achieve targeted RWA initiatives strengthened our CET1 ratio, creating capacity for

growth.

• The leverage ratio remained strong at 5.0%.

For further information on financial performance, see the Financial Summary and pages 22 to 27 of the Strategic Report.

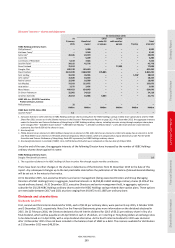

Group variable pay pool and risk adjustments

Remuneration is an important tool for instilling the right

behaviours, driving and encouraging actions that are

aligned to organisational values and expectations. I believe

there should be a positive reward for achieving results in

the right way – and a penalty when they are not.

To drive positive change and influence the correct

behaviour, we launched a global At Our Best recognition

programme in July 2015, to be fully implemented by April

2016. This global programme enables everyone at HSBC

to recognise colleagues around the world who bring our

values to life in the way they think and act. It provides a

global shared understanding of what HSBC Values look like

in practice, and a consistent way of recognising people who

demonstrate them.

Where our aim to drive positive change is unsuccessful,

we have a process under which we apply downward

adjustments both at the variable pay pool level and at

the individual employee level. The 2015 variable pay was

determined after taking an automatic adjustment of

$431m to reflect fines, penalties and the cost of customer

redress. The Committee also reduced the payout ratio

from a target of 18.25% to 16%. This resulted in a further

adjustment of $398m to the variable pay pool. Additionally,

there were a number of actions taken, to reduce variable

pay proposed for 2015 for Group employees by $11m,

including members of senior management on account

of certain notable events that took place in the period.

The Group’s policy is for the vast majority of post-tax

profits to be allocated to capital retention and to dividends,

as described on page 304.

The Committee also reviewed the recommendation on

performance management and incentives in a report

issued by the G30: Banking Conduct and Culture: A Call

for Sustained and Comprehensive Reform. The review

confirmed that our practice on remuneration and

performance management is aligned with the

recommendations in the G30 report.

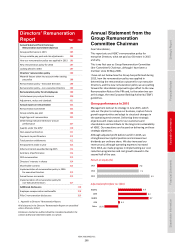

How our remuneration policy was applied

in 2015

Based on performance of the executive Directors against

their 2015 scorecards, the Committee approved 2015

annual incentive awards at 45% of the maximum for

Stuart Gulliver, 80.1% of the maximum for Iain Mackay

and 62% of the maximum for Marc Moses (details of the

performance outcomes are on page 307).

In respect of the Group Performance Share Plan (‘GPSP’),

we determined that 41.3% of the maximum award should

be granted (details of the performance outcomes are on

page 310).

In aggregate, total compensation for the Group Chief

Executive (‘CEO’) is down from 2014 reflecting the weaker

financial performance of the Group and the progress

towards implementation of Global Standards during

the year.

Before confirming the total variable pay to be awarded to the

executive Directors, we took into account reports from the

independent Monitor and received inputs from the Financial

System Vulnerabilities Committee on the progress on the

implementation of the Monitor’s recommendations on AML

and sanctions compliance and other Global Standards-related

initiatives. Based on the inputs received and each executive

Directors’ HSBC Values rating, we assessed that no further

downward override adjustment is required in respect of the

executive Directors or senior executives.

A significant portion of the variable pay awards for

executive Directors is deferred and subject to malus during

the vesting period. In addition, all variable pay awards are

subject to clawback for a minimum period of seven years

from the date of grant. The breakdown of the variable pay

award and the period over which the awards are paid are

set out on page 294.