Cigna 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

Other Operations Segment

Segment Description

Other Operations consist of:

x non-leveraged and leveraged corporate–owned life insurance (“COLI”);

x deferred gains recognized from the 1998 sale of the individual life insurance and annuity business and the 2004 sale of the

retirement benefits business; and

x run-off settlement annuity business.

COLI has contributed the majority of the earnings in 2009, 2008 and 2007 for Other Operations. Federal legislation enacted in 1996

affected certain policies sold by the COLI business by eliminating on a prospective basis the tax deduction for policy loan interest for

most leveraged COLI products. There have been no sales of this particular product since 1997. As a result of an Internal Revenue

Service initiative to settle tax disputes regarding leveraged products, some customers have surrendered their policies and management

expects earnings associated with these products to continue to decline. Management does not expect this initiative to have a

significant impact on the future operating results of the segment.

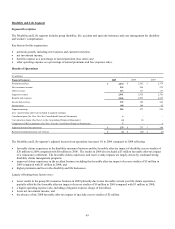

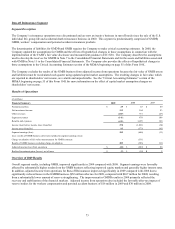

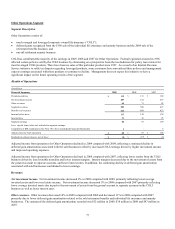

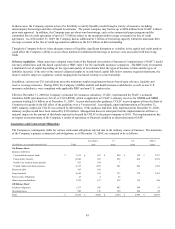

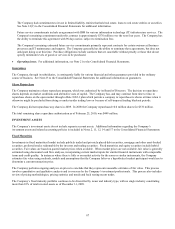

Results of Operations

(In millions)

Financial Summary 2009 2008 2007

Premiums and fees $ 112 $ 113 $ 108

Net investment income 407 414 437

Other revenues 64 71 82

Segment revenues 583 598 627

Benefits and expenses 466 468 473

Income before taxes 117 130 154

Income taxes 31 43 45

Segment earnings 86 87 109

Less: special items (after-tax) included in segment earnings:

Completion of IRS examination (See Note 19 to the Consolidated Financial Statements) 1 - 5

Adjusted income from operations $ 85 $ 87 $ 104

Realized investment (losses), net of taxes $ (6) $(27) $(2)

Adjusted income from operations for Other Operations declined in 2009 compared with 2008, reflecting a continued decline in

deferred gain amortization associated with the sold businesses offset by increased COLI earnings driven by higher investment income

and improved operating expenses.

Adjusted income from operations for Other Operations declined in 2008 compared with 2007, reflecting lower results from the COLI

business driven by less favorable mortality and lower interest margins. Interest margins decreased due to the movement of assets from

the general account to separate accounts, and lower interest rates. In addition, the continuing decline in deferred gain amortization

associated with sold businesses contributed to lower earnings.

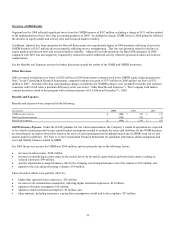

Revenues

Net investment income. Net investment income decreased 2% in 2009 compared with 2008, primarily reflecting lower average

invested assets and lower real estate income. Net investment income decreased 5% in 2008 compared with 2007 primarily reflecting

lower average invested assets due in part to the movement of assets from the general account to separate accounts in the COLI

business as well as lower interest rates.

Other revenues. Other revenues decreased 10% in 2009 compared with 2008 and decreased 13% in 2008 compared with 2007

primarily due to lower deferred gain amortization related to the sold retirement benefits and individual life insurance and annuity

businesses. The amount of the deferred gain amortization recorded was $32 million in 2009, $38 million in 2008 and $47 million in

2007.