Cigna 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

C. Investments

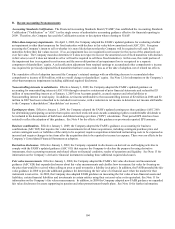

The Company's accounting policies for investment assets are discussed below:

Fixed maturities and equity securities. Fixed maturities include bonds, mortgage and other asset-backed securities and preferred

stocks redeemable by the investor. Equity securities include common stocks and preferred stocks that are non-redeemable or

redeemable only by the issuer. These investments are primarily classified as available for sale and are carried at fair value with

changes in fair value recorded in accumulated other comprehensive income (loss) within shareholders’ equity. Beginning April 1,

2009, when the Company determines it does not expect to recover the amortized cost basis of fixed maturities with declines in fair

value (even if it does not intend to sell or will not be required to sell these fixed maturities), the credit portion of the impairment loss is

recognized in net income and the non-credit portion, if any, is recognized in a separate component of shareholders’ equity. The credit

portion is the difference between the amortized cost basis of the fixed maturity and the net present value of its projected future cash

flows. Projected future cash flows are based on qualitative and quantitative factors, including probability of default, and the estimated

timing and amount of recovery. For mortgage and asset-backed securities, estimated future cash flows are based on assumptions

about the collateral attributes including prepayment speeds, default rates and changes in value. Equity securities and, prior to April 1,

2009, fixed maturities were considered impaired, and their cost basis was written down to fair value through earnings, when

management did not expect to recover the amortized cost, or if the Company could not demonstrate its intent or ability to hold the

investment until full recovery. Fixed maturities and equity securities also include certain trading and hybrid securities carried at fair

value with changes in fair value reported in realized investment gains and losses, beginning after the implementation of updated

guidance on certain hybrid financial instruments on January 1, 2007. The Company elected fair value accounting for certain hybrid

securities to simplify accounting and mitigate volatility in results of operations and financial condition.

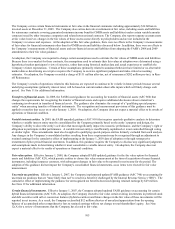

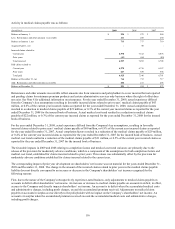

Commercial mortgage loans. Mortgage loans held by the Company are made exclusively to commercial borrowers, therefore there is

no exposure to either prime or sub-prime residential mortgages. Generally, commercial mortgage loans are carried at unpaid principal

balances and are issued at a fixed rate of interest. Commercial mortgage loans held for sale are carried at the lower of unpaid principal

balance or fair value with any resulting valuation allowance reported in realized investment gains and losses. Commercial mortgage

loans are considered impaired when it is probable that the Company will not collect amounts due according to the terms of the original

loan agreement. Impaired loans are carried at the lower of unpaid principal or fair value of the underlying collateral. Valuation

reserves reflect any changes in fair value. The Company estimates the fair value of the underlying collateral using internal valuations

generally based on discounted cash flow analyses.

Policy loans. Policy loans are carried at unpaid principal balances.

Real estate. Investment real estate can be “held and used” or “held for sale”. The Company accounts for real estate as follows:

x Real estate "held and used" is expected to be held longer than one year and includes real estate acquired through the foreclosure of

commercial mortgage loans. The Company carries real estate held and used at depreciated cost less any write-downs to fair value

due to impairment and assesses impairment when cash flows indicate that the carrying value may not be recoverable.

Depreciation is generally calculated using the straight-line method based on the estimated useful life of the particular real estate

asset.

x Real estate is "held for sale" when a buyer’s investigation is completed, a deposit has been received and the sale is expected to be

completed within the next year. Real estate held for sale is carried at the lower of carrying value or current fair value, less

estimated costs to sell, and is not depreciated. Valuation reserves reflect any changes in fair value.

x The Company uses several methods to determine the fair value of real estate, but relies primarily on discounted cash flow

analyses and, in some cases, third-party appraisals.

At the time of foreclosure, properties are reclassified from commercial mortgage loans to real estate. The Company rehabilitates, re-

leases and sells foreclosed properties. This process usually takes from two to four years unless management considers a near-term

sale preferable.

Other long-term investments. Other long-term investments include investments in unconsolidated entities. These entities include

certain limited partnerships and limited liability companies holding real estate, securities or loans. These investments are carried at

cost plus the Company’s ownership percentage of reported income or loss in cases where the Company has significant influence,

otherwise the investment is carried at cost. Income from certain entities is reported on a one quarter lag depending on when their

financial information is received. Also included in other long-term investments are loans to unconsolidated real estate entities secured

by the equity interests of these real estate entities, which are carried at unpaid principal balances (mezzanine loans). These other long-

term investments are considered impaired, and written down to their fair value, when cash flows indicate that the carrying value may

not be recoverable. Fair value is generally determined based on a discounted cash flow analysis.