Cigna 2009 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144

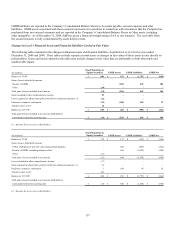

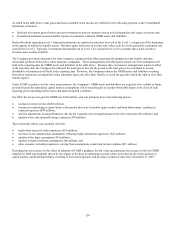

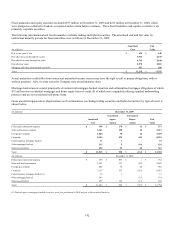

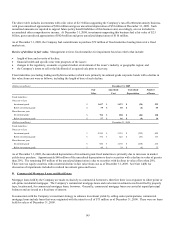

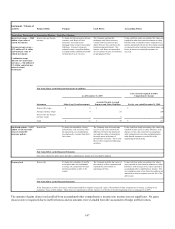

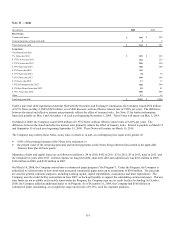

At December 31, commercial mortgage loans and real estate investments were distributed among the following property types and

geographic regions:

(In millions) 2009 2008

Property type

Office buildings $ 1,161 $ 1,118

Apartment buildings 901 988

Industrial 595 546

Hotels 499 512

Retail facilities 426 441

Other 64 65

Total $ 3,646 $ 3,670

Geographic region

Pacific $ 1,069 $ 1,102

South Atlantic 735 779

New England 582 546

Central 517 512

Middle Atlantic 408 394

Mountain 335 337

Total $ 3,646 $ 3,670

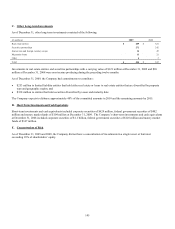

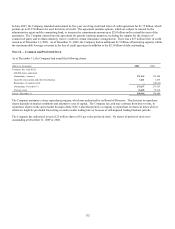

At December 31, 2009, scheduled commercial mortgage loan maturities were as follows (in millions): $278 in 2010, $394 in 2011,

$644 in 2012, $613 in 2013 and $1,593 thereafter.

Actual maturities could differ from contractual maturities for several reasons: borrowers may have the right to prepay obligations,

with or without prepayment penalties; the maturity date may be extended; and loans may be refinanced.

Real estate investments with a carrying value of $55 million at December 31, 2009 and $13 million at December 31, 2008 were non-

income producing during the preceding twelve months.

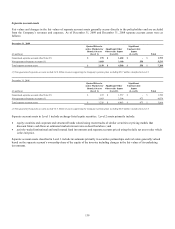

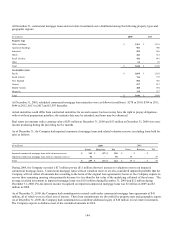

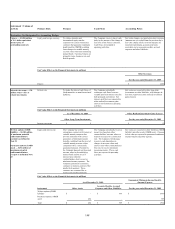

As of December 31, the Company had impaired commercial mortgage loans and related valuation reserves (excluding loans held for

sale) as follows:

(In millions) 2009 2008

Gross Reserves Net Gross Reserves Net

Impaired commercial mortgage loans with valuation reserves $ 143 $ (17) $ 126 $ - $ - $ -

Impaired commercial mortgage loans with no valuation reserves 96 - 96 59 - 59

Total $ 239 $ (17) $ 222 $ 59 $ - $ 59

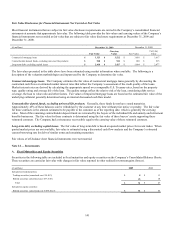

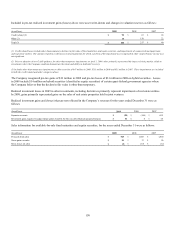

During 2009, the Company recorded a $17 million pre-tax ($11 million after-tax) increase to valuation reserves on impaired

commercial mortgage loans. Commercial mortgage loans without valuation reserves are also considered impaired (probable that the

Company will not collect all amounts due according to the terms of the original loan agreements); however, the Company expects to

recover their remaining carrying value primarily because it is less than the fair value of the underlying collateral of these loans. The

average recorded investment in impaired mortgage loans was $116 million during December 31, 2009 and $12 million during

December 31, 2008. Pre-tax interest income recognized on impaired commercial mortgage loans was $3 million in 2009 and $1

million in 2008.

As of December 31, 2009, the Company had commitments to extend credit under commercial mortgage loan agreements of $41

million, all of which were at a fixed rate of interest. These loan commitments are diversified by property type and geographic region.

As of December 31, 2009, the Company had commitments to contribute additional equity of $10 million to real estate investments.

The Company expects to disburse most of the committed amounts in 2010.