Cigna 2009 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228

|

|

133

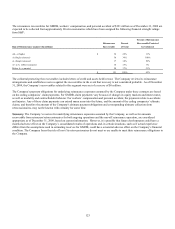

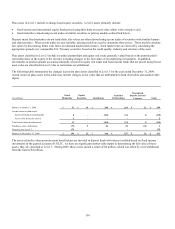

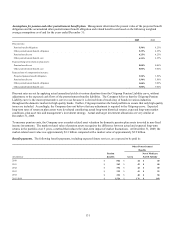

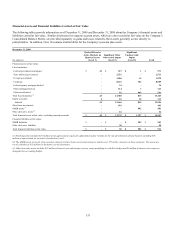

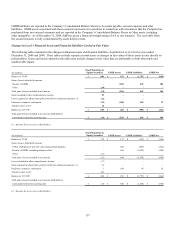

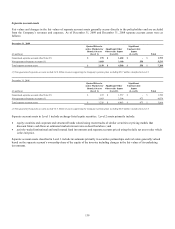

Financial Assets and Financial Liabilities Carried at Fair Value

The following tables provide information as of December 31, 2009 and December 31, 2008 about the Company’s financial assets and

liabilities carried at fair value. Similar disclosures for separate account assets, which are also recorded at fair value on the Company’s

Consolidated Balance Sheets, are provided separately as gains and losses related to these assets generally accrue directly to

policyholders. In addition, Note 10 contains similar tables for the Company’s pension plan assets.

December 31, 2009

(In millions)

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Total

Financial assets at fair value:

Fixed maturities:

Federal government and agency $ 43 $ 527 $ 1 $ 571

State and local government - 2,521 - 2,521

Foreign government - 1,056 14 1,070

Corporate - 8,241 344 8,585

Federal agency mortgage-backed - 34 - 34

Other mortgage-backed - 114 7 121

Other asset-backed - 92 449 541

Total fixed maturities (1) 43 12,585 815 13,443

Equity securities 2 81 30 113

Subtotal 45 12,666 845 13,556

Short-term investments - 493 - 493

GMIB assets (2) - - 482 482

Other derivative assets (3) - 16 - 16

Total financial assets at fair value, excluding separate accounts $ 45 $ 13,175 $ 1,327 $ 14,547

Financial liabilities at fair value:

GMIB liabilities $ - $ - $ 903 $ 903

Other derivative liabilities - 30 - 30

Total financial liabilities at fair value $ - $ 30 $ 903 $ 933

(1) Fixed maturities includes $274 million of net appreciation required to adjust future policy benefits for the run-off settlement annuity business including $38

million of appreciation for securities classified in Level 3.

(2) The GMIB assets represent retrocessional contracts in place from two external reinsurers which cover 55% of the exposures on these contracts. The assets are

net of a liability of $15 million for the future cost of reinsurance.

(3) Other derivative assets includes $12 million of interest rate and foreign currency swaps qualifying as cash flow hedges and $4 million of interest rate swaps not

designated as accounting hedges.