Cigna 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

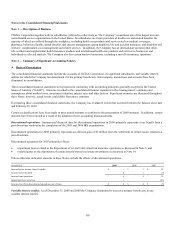

B. Recent Accounting Pronouncements

Accounting Standards Codification. The Financial Accounting Standards Board (“FASB”) has established the Accounting Standards

Codification (“Codification” or “ASC”) as the single source of authoritative accounting guidance effective for financial reporting in

2009. Therefore, the Company has used the Codification section or description when referring to GAAP.

Other-than-temporary impairments. On April 1, 2009, the Company adopted the FASB’s updated guidance for evaluating whether

an impairment is other than temporary for fixed maturities with declines in fair value below amortized cost (ASC 320). It requires

assessing the Company’s intent to sell or whether it is more likely than not that the Company will be required to sell such fixed

maturities before their fair values recover. If so, an impairment loss is recognized in net income for the excess of the amortized cost

over fair value. The Company must also determine if it does not expect to recover the amortized cost of fixed maturities with declines

in fair value (even if it does not intend to sell or will not be required to sell these fixed maturities). In this case, the credit portion of

the impairment loss is recognized in net income and the non-credit portion of an impairment loss is recognized in a separate

component of shareholders’ equity. A reclassification adjustment from retained earnings to accumulated other comprehensive income

was required for previously impaired fixed maturities that have a non-credit loss as of the date of adoption, net of related tax effects.

The cumulative effect of adoption increased the Company’s retained earnings with an offsetting decrease to accumulated other

comprehensive income of $18 million, with no overall change to shareholders’ equity. See Note 12 for information on the Company’s

other-than-temporary impairments including additional required disclosures.

Noncontrolling interests in subsidiaries. Effective January 1, 2009, the Company adopted the FASB’s updated guidance on

accounting for noncontrolling interests (ASC 810) through retroactive restatement of prior financial statements and reclassified $3

million of noncontrolling interest as of January 1, 2007 from Accounts payable, accrued expenses and other liabilities to

Noncontrolling interest in total equity. In addition, net income attributable to the noncontrolling interest of $2 million in 2008 and $3

million in 2007 has been reclassified to be included in net income, with a reduction to net income to determine net income attributable

to the Company’s shareholders (“shareholders’ net income”).

Earnings per share. Effective January 1, 2009, the Company adopted the FASB’s updated earnings per share guidance (ASC 260)

for determining participating securities that requires unvested restricted stock awards containing rights to nonforfeitable dividends to

be included in the denominator of both basic and diluted earnings per share (“EPS”) calculations. Prior period EPS data have been

restated to reflect the adoption of this guidance. See Note 4 for the effects of this guidance on previously reported EPS amounts.

Business combinations. Effective January 1, 2009, the Company adopted the FASB’s guidance on accounting for business

combinations (ASC 805) that requires fair value measurements for all future acquisitions, including contingent purchase price and

certain contingent assets or liabilities of the entity to be acquired, requires acquisition-related and restructuring costs to be expensed as

incurred and requires changes in tax items after the acquisition date to be reported in income tax expense. There were no effects to the

Company’s Consolidated Financial Statements at adoption.

Derivatives disclosures. Effective January 1, 2009, the Company expanded its disclosures on derivatives and hedging activities to

comply with the FASB’s updated guidance (ASC 815) that requires the Company to disclose the purpose for using derivative

instruments, their accounting treatment and related effects on financial condition, results of operations and liquidity. See Note 13 for

information on the Company’s derivative financial instruments including these additional required disclosures.

Fair value measurements. Effective January 1, 2008, the Company adopted the FASB’s fair value disclosure and measurement

guidance (ASC 820) that expands disclosures about fair value measurements and clarifies how to measure fair value by focusing on

the price that would be received when selling an asset or paid to transfer a liability (exit price). In addition, the FASB amended the fair

value guidance in 2008 to provide additional guidance for determining the fair value of a financial asset when the market for that

instrument is not active. In 2009, the Company also adopted FASB guidance on measuring the fair value of non-financial assets and

liabilities, certain financial liabilities and investments in certain entities using their net asset value or its equivalent. See Note 11 for

information on the Company’s fair value measurements. In addition, in 2009 the Company adopted new FASB guidance on expanded

fair value disclosures for assets supporting its pension and other postretirement benefit plans. See Note 10 for further information.