Cigna 2009 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.118

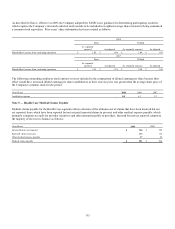

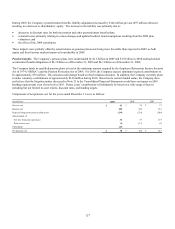

In order to substantially reduce the equity market exposures relating to guaranteed minimum death benefit contracts, the Company

operates a dynamic hedge program (“GMDB equity hedge program”), using exchange-traded futures contracts. The hedge program is

designed to offset both positive and negative impacts of changes in equity markets on the GMDB liability. The hedge program

involves detailed, daily monitoring of equity market movements and rebalancing the futures contracts within established parameters.

While the hedge program is actively managed, it may not exactly offset changes in the GMDB liability due to, among other things,

divergence between the performance of the underlying mutual funds and the hedge instruments, high levels of volatility in the equity

markets, and differences between actual contractholder behavior and what is assumed. The performance of the underlying mutual

funds compared to the hedge instruments is further impacted by a time lag, since the data is not reported and incorporated into the

required hedge position on a real time basis. Although this hedge program does not qualify for GAAP hedge accounting, it is an

economic hedge because it is designed to reduce and is effective in reducing equity market exposures resulting from this product. The

results of the futures contracts are included in other revenue and amounts reflecting corresponding changes in liabilities for these

GMDB contracts are included in benefits and expenses.

In 2000, the Company determined that the GMDB reinsurance business was premium deficient because the recorded future policy

benefit reserve was less than the expected present value of future claims and expenses less the expected present value of future

premiums and investment income using revised assumptions based on actual and expected experience. As a result, the Company

increased its reserves. Since that time, the Company has tested for premium deficiency by performing a reserve review on a quarterly

basis using current market conditions and assumptions. Under premium deficiency accounting, if the recorded reserve is determined

insufficient, an increase to the reserve is reflected as a charge to current period income. Consistent with GAAP, the Company does not

recognize gains on premium deficient long duration products.

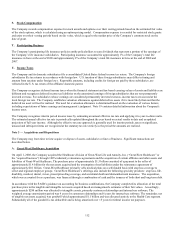

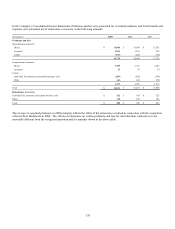

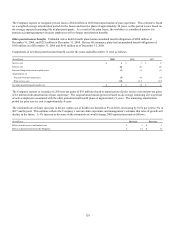

The Company had future policy benefit reserves for GMDB contracts of $1.3 billion as of December 31, 2009, and $1.6 billion as of

December 31, 2008. The determination of liabilities for GMDB requires the Company to make critical accounting estimates. The

Company estimates its liabilities for GMDB exposures using a complex internal model run using many scenarios and based on

assumptions regarding lapse, future partial surrenders, mortality, interest rates (mean investment performance and discount rate) and

volatility. Lapse refers to the full surrender of an annuity prior to a contractholder’s death. Future partial surrender refers to the fact

that most contractholders have the ability to withdraw substantially all of their mutual fund investments while retaining the death

benefit coverage in effect at the time of the withdrawal. Mean investment performance for underlying equity mutual funds refers to

market rates expected to be earned on the hedging instruments over the life of the GMDB equity hedge program, and for underlying

fixed income mutual funds refers to the expected market return over the life of the contracts. Market volatility refers to market

fluctuation. These assumptions are based on the Company’s experience and future expectations over the long-term period, consistent

with the long-term nature of this product. The Company regularly evaluates these assumptions and changes its estimates if actual

experience or other evidence suggests that assumptions should be revised. If actual experience differs from the assumptions

(including lapse, future partial surrenders, mortality, interest rates and volatility) used in estimating these liabilities, the result could

have a material adverse effect on the Company’s consolidated results of operations, and in certain situations, could have a material

adverse effect on the Company’s financial condition.