Cigna 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

MARKET RISK

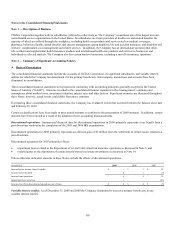

Financial Instruments

The Company’s assets and liabilities include financial instruments subject to the risk of potential losses from adverse changes in

market rates and prices. The Company’s primary market risk exposures are:

x Interest-rate risk on fixed-rate, domestic, medium-term instruments. Changes in market interest rates affect the value of

instruments that promise a fixed return and impact the value of liabilities for reinsured GMDB and GMIB contracts.

x Foreign currency exchange rate risk of the U.S. dollar primarily to the South Korean won, Taiwan dollar, euro, British pound,

New Zealand dollar, and Hong Kong dollar. An unfavorable change in exchange rates reduces the carrying value of net assets

denominated in foreign currencies.

x Equity price risk for domestic equity securities and for the value of reinsured GMDB and GMIB contracts resulting from

unfavorable changes in variable annuity account values based on underlying mutual fund investments.

For further discussion of reinsured contracts, see Note 7 for GMDB contracts and Note 11 for GMIB contracts in the Consolidated

Financial Statements.

The Company’s Management of Market Risks

The Company predominantly relies on three techniques to manage its exposure to market risk:

x Investment/liability matching. The Company generally selects investment assets with characteristics (such as duration, yield,

currency and liquidity) that correspond to the underlying characteristics of its related insurance and contractholder liabilities so

that the Company can match the investments to its obligations. Shorter-term investments support generally shorter-term life and

health liabilities. Medium-term, fixed-rate investments support interest-sensitive and health liabilities. Longer-term investments

generally support products with longer pay out periods such as annuities and long-term disability liabilities.

x Use of local currencies for foreign operations. The Company generally conducts its international business through foreign

operating entities that maintain assets and liabilities in local currencies. While this technique does not reduce the Company’s

foreign currency exposure of its net assets, it substantially limits exchange rate risk to those net assets.

x Use of derivatives. The Company generally uses derivative financial instruments to minimize certain market risks and, from time

to time, to enhance investment returns.

See Notes 2(C) and 13 to the Consolidated Financial Statements for additional information about financial instruments, including

derivative financial instruments.

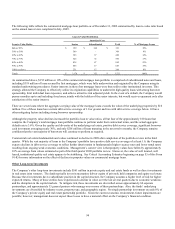

Effect of Market Fluctuations on the Company

The examples that follow illustrate the effect of hypothetical changes in market rates or prices on the fair value of certain financial

instruments including:

x hypothetical changes in market interest rates, primarily for fixed maturities and commercial mortgage loans, partially offset by

liabilities for long-term debt and GMIB contracts;

x hypothetical changes in market rates for foreign currencies, primarily for the net assets of foreign subsidiaries denominated in a

foreign currency; and

x hypothetical changes in market prices for equity exposures, primarily for equity securities and GMIB contracts.

In addition, hypothetical effects of changes in equity indices and foreign exchange rates are presented separately for futures contracts

used in the GMDB equity hedge program.