Cigna 2009 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

151

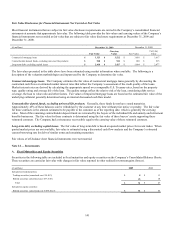

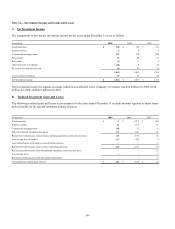

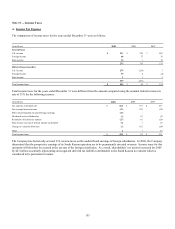

Note 15 Debt

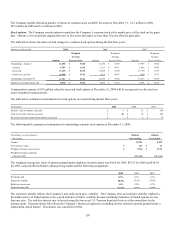

(In millions) 2009 2008

Short-term:

Commercial paper $ 100 $ 299

Current maturities of long-term debt 4 2

Total short-term debt $ 104 $ 301

Long-term:

Uncollateralized debt:

7% Notes due 2011 $ 222 $ 222

6.375% Notes due 2011 226 226

5.375% Notes due 2017 250 250

6.35% Notes due 2018 300 300

8.5% Notes due 2019 349 -

6.37% Notes due 2021 78 78

7.65% Notes due 2023 100 100

8.3% Notes due 2023 17 17

7.875% Debentures due 2027 300 300

8.3% Step Down Notes due 2033 83 83

6.15% Notes due 2036 500 500

Other 11 14

Total long-term debt $ 2,436 $ 2,090

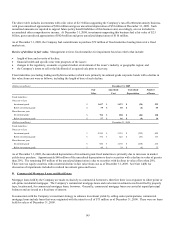

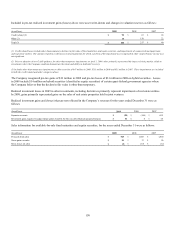

Under a universal shelf registration statement filed with the Securities and Exchange Commission, the Company issued $350 million

of 8.5% Notes on May 4, 2009 ($349 million, net of debt discount, with an effective interest rate of 9.90% per year). The difference

between the stated and effective interest rates primarily reflects the effect of treasury locks. See Note 13 for further information.

Interest is payable on May 1 and November 1 of each year beginning November 1, 2009. These Notes will mature on May 1, 2019.

On March 4, 2008, the Company issued $300 million of 6.35% Notes (with an effective interest rate of 6.68% per year). The

difference between the stated and effective interest rates primarily reflects the effect of treasury locks. Interest is payable on March 15

and September 15 of each year beginning September 15, 2008. These Notes will mature on March 15, 2018.

The Company may redeem these Notes, at any time, in whole or in part, at a redemption price equal to the greater of:

x 100% of the principal amount of the Notes to be redeemed; or

x the present value of the remaining principal and interest payments on the Notes being redeemed discounted at the applicable

Treasury Rate plus 40 basis points.

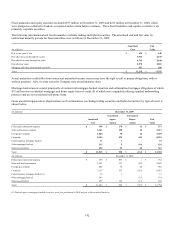

Maturities of debt and capital leases are as follows (in millions): $4 in 2010, $452 in 2011, $3 in 2012, $3 in 2013, none in 2013 and

the remainder in years after 2013. Interest expense on long-term debt, short-term debt and capital leases was $166 million in 2009,

$146 million in 2008, and $122 million in 2007.

On March 14, 2008, the Company entered into a commercial paper program (“the Program”). Under the Program, the Company is

authorized to sell from time to time short-term unsecured commercial paper notes up to a maximum of $500 million. The proceeds

are used for general corporate purposes, including working capital, capital expenditures, acquisitions and share repurchases. The

Company uses the credit facility entered into in June 2007, as back-up liquidity to support the outstanding commercial paper. If at any

time funds are not available on favorable terms under the Program, the Company may use its credit facility for funding. In October

2008, the Company added an additional dealer to its Program. As of December 31, 2009, the Company had $100 million in

commercial paper outstanding, at a weighted average interest rate of 0.35%, used for corporate purposes.