Albertsons 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to significantly reduce contributions, exit certain markets or otherwise cease making contributions to these

plans, it could trigger a partial or complete withdrawal that would require the Company to fund its

proportionate share of a plan’s unfunded vested benefits.

The Company also makes contributions to multi-employer health and welfare plans in amounts set forth in the

related collective bargaining agreements. A small minority of collective bargaining agreements contain reserve

requirements that may trigger unanticipated contributions resulting in increased healthcare expenses. If these

healthcare provisions cannot be renegotiated in a manner that reduces the prospective healthcare cost as the

Company intends, the Company’s Selling and administrative expenses could increase in the future.

NOTE 15—SHAREHOLDER RIGHTS PLAN

On April 24, 2000, the Company announced that the Board of Directors adopted a Shareholder Rights Plan

under which one preferred stock purchase right is distributed for each outstanding share of common stock. The

rights, which expire on April 12, 2010, are exercisable only under certain conditions, and may be redeemed by

the Board of Directors for $0.01 per right. The plan contains a three-year independent director evaluation

provision whereby a committee of the Company’s independent directors will review the plan at least once

every three years. The rights become exercisable, with certain exceptions, after a person or group acquires

beneficial ownership of 15 percent or more of the outstanding voting stock of the Company.

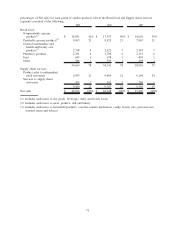

NOTE 16—SEGMENT INFORMATION

Refer to the Consolidated Segment Financial Information for financial information concerning the Company’s

operations by reportable segment.

The Company’s operating segments, as defined by SFAS No. 131, “Disclosures about Segments of an

Enterprise and Related Information,” reflect the manner in which the business is managed and how the

Company allocates resources and assesses performance internally.

Our chief operating decision maker is our Chairman and Chief Executive Officer. The Company offers a wide

variety of grocery products, general merchandise and health and beauty care, pharmacy, fuel and other items

and services. The Company’s business is classified by management into two reportable segments: Retail food

and Supply chain services. These reportable segments are two distinct businesses, one retail and one wholesale,

each with a different customer base, marketing strategy and management structure. The Retail food reportable

segment is an aggregation of the Company’s retail operating segments, which are primarily organized based on

geography.

The Retail food operating segments are aggregated as the products sold in the grocery stores are substantially

the same, focusing on food and related products; the customer or potential customer for each of the retail

operating segments is the same, any consumer of food and related products; each of the retail operating

segments use the same distribution method for its products, the sale of items through grocery stores; and all of

the Company’s retail operating segments are subject to similar regulation. Additionally, the retail operating

segments are aggregated into one Retail food reportable segment as they have similar economic characteristics

and are expected to have similar long-term financial performance, based on operating earnings as a percent of

sales.

The Retail food reportable segment derives revenues from the sale of groceries at retail locations operated by

the Company (both the Company’s own stores and stores licensed by the Company). The Supply chain

services reportable segment derives revenues from wholesale distribution to independently owned retail food

stores, mass merchants and other customers (collectively referred to as “independent retail customers”) and

logistics support services.

The Company offers a wide variety of nationally advertised brand name and private brand name products,

primarily including grocery (both perishable and nonperishable), general merchandise and health and beauty

care, pharmacy and fuel, which are sold through the Company’s own and licensed retail food stores to

shoppers and through its Supply chain services business to independent retail customers. The amounts and

71