Albertsons 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2008, the FASB issued FSP FAS 132(R)-1, “Employers’ Disclosures about Postretirement Benefit

Plan Assets.” FSP FAS 132(R)-1 provides additional guidance regarding disclosures about plan assets of

defined benefit pension or other postretirement plans. FSP FAS 132(R)-1 will be effective for the Company’s

fiscal year beginning March 1, 2009. The adoption of FSP FAS 132(R)-1 will result in enhanced disclosures,

but will not otherwise have an impact on the Company’s consolidated financial statements.

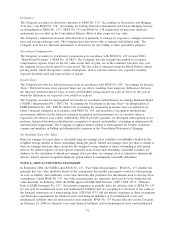

NOTE 3—GOODWILL AND INTANGIBLE ASSETS

Changes in the Company’s Goodwill and Intangible assets consisted of the following:

February 24,

2007

Additions/

Amortization

Other net

adjustments

February 23,

2008

Additions/

Amortization Impairment

Other net

adjustments

February 28,

2009

Goodwill $5,921 $ 57 $ 979 $6,957 $ — $(3,223) $ 14 $3,748

Intangible assets:

Trademarks and

tradenames—indefin-

ite lived $1,384 $ 1 $ (15) $1,370 $ — $ (301) $ — $1,069

Favorable operating

leases, customer lists,

customer

relationships and

other (accumulated

amortization of $197

and $141, as of

February 28, 2009

and February 23,

2008, respectively) 1,130 12 (425) 717 14 — (25) 706

Non-compete

agreements

(accumulated

amortization of $4

and $9 as of

February 28, 2009

and February 23,

2008, respectively) 13 3 (1) 15 1 — (6) 10

Total intangible assets 2,527 16 (441) 2,102 15 (301) (31) 1,785

Accumulated amortization (77) (55) (18) (150) (65) — 14 (201)

Total intangible assets, net $2,450 $1,952 $1,584

In accordance with SFAS No. 142, the Company applies a fair value-based impairment test to the net book

value of goodwill and indefinite-lived intangible assets on an annual basis and on an interim basis if certain

events or circumstances indicate that an impairment loss may have occurred. For the third quarter of fiscal

2009, the Company’s stock price had a significant and sustained decline and book value per share substantially

exceeded the stock price. Consistent with SFAS No. 142, the Company performed an interim impairment test

of goodwill and indefinite-lived intangible assets at the end of the third quarter of fiscal 2009. Although this

analysis had not been completed due to its complexity, the Company recorded a preliminary estimate of

impairment charges in the third quarter of $3,250, comprised of $3,000 to goodwill at certain Retail food

reporting units and $250 to indefinite-lived trademarks and tradenames related to the Acquired Trademarks. In

the fourth quarter, the Company finalized the impairment analysis and recorded additional impairment charges

of $274, comprised of $223 to goodwill for the same Retail food reporting units and $51 to the same

indefinite-lived trademarks and tradenames and other intangible assets. The impairment of goodwill and

indefinite-lived intangible assets reflects the significant decline in the market price of the Company’s common

stock as of the end of the third quarter of fiscal 2009 as well as the impact of the unprecedented decline in the

economy on the Company’s plan. The Company did not record any impairment losses related to goodwill or

intangible assets during fiscal 2008.

53