Albertsons 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

from its efficient and low-cost supply chain and new economies of scale as it leverages its Retail food and

Supply chain services operations. The Company plans to expand retail square footage through targeted new

store development, remodel activities, licensee growth and acquisitions.

The Company is in the third year of implementing its integration plan that commenced with the Acquisition,

including initiatives to leverage scale and reduce costs in the Company’s Retail food and Supply chain services

businesses to enhance the overall performance of the newly combined company, which it expects to substantially

complete in fiscal 2010. The Company has a long-term goal for approximately 80 percent of its store fleet to be

new or newly remodeled within the last seven years. During fiscal 2009, the Company opened 14 new

combination and food stores and completed approximately 161 major store remodels, which aligns the Company

with making progress towards this goal. The Company’s capital spending for fiscal 2010 is projected to be

approximately $750, including capital leases, which will include 75 to 80 major store remodels and three new

combination and food stores. The Company also plans to reduce debt by approximately $700 in fiscal 2010.

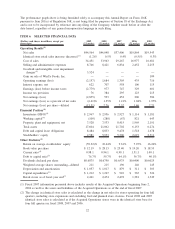

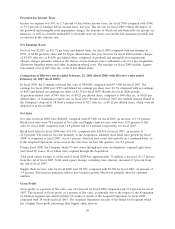

RESULTS OF OPERATIONS

Highlights of results of operations as reported and as a percent of Net sales are as follows:

(In millions, except per share data)

February 28,

2009

(53 weeks)

February 23,

2008

(52 weeks)

February 24,

2007

(52 weeks)

Net sales $44,564 100.0% $44,048 100.0% $37,406 100.0%

Cost of sales 34,451 77.3 33,943 77.1 29,267 78.2

Selling and administrative expenses 8,746 19.6 8,421 19.1 6,834 18.3

Goodwill and intangible asset impairment charges 3,524 7.9 — — — —

Operating earnings (loss) $ (2,157) (4.8) $ 1,684 3.8 $ 1,305 3.5

Interest expense 633 1.4 725 1.6 600 1.6

Interest income 11 0.0 18 0.0 42 0.1

Earnings (loss) before income taxes $ (2,779) (6.2) $ 977 2.2 $ 747 2.0

Income tax provision 76 0.2 384 0.9 295 0.8

Net earnings (loss) $ (2,855) (6.4)% $ 593 1.3% $ 452 1.2%

Net earnings (loss) per share—diluted $ (13.51) $ 2.76 $ 2.32

Comparison of fifty-three weeks ended February 28, 2009 (fiscal 2009) with fifty-two weeks ended

February 23, 2008 (fiscal 2008):

In fiscal 2009, the Company achieved Net sales of $44,564, compared with $44,048 last year. Net loss for

fiscal 2009 was $2,855 and diluted net loss per share was $13.51, compared with net earnings of $593 and

diluted net earnings per share of $2.76 last year. Results for fiscal 2009 include charges of $3,762 before tax

($3,470 after tax, or $16.40 per diluted share) comprised of goodwill and intangible asset impairment charges

of $3,524 before tax ($3,326 after tax, or $15.71 per diluted share), charges primarily related to the closure of

non-strategic stores of $200 before tax ($121 after tax, or $0.58 per diluted share), settlement costs for a pre-

Acquisition Albertsons litigation matter of $24 before tax ($15 after tax, or $0.07 per diluted share) and other

Acquisition-related costs (defined as one-time transaction costs, which primarily include supply chain

consolidation costs, employee-related benefit costs and consultant fees) of $14 before tax ($8 after tax, or

$0.04 per diluted share). Results for fiscal 2008 include Acquisition-related costs of $73 before tax ($45 after

tax, or $0.21 per diluted share).

Net Sales

Net sales for fiscal 2009 were $44,564, compared with $44,048 last year. Retail food sales were 77.8 percent

of Net sales and Supply chain services sales were 22.2 percent of Net sales for fiscal 2009, compared with

78.0 percent and 22.0 percent, respectively, last year.

24