Albertsons 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

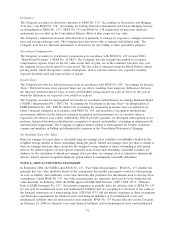

Deferred income taxes reflect the net tax effects of temporary differences between the bases of assets and

liabilities for financial reporting and income tax purposes. The Company’s deferred tax assets and liabilities

consisted of the following:

2009 2008

Deferred tax assets:

Compensation and benefits $ 575 $ 330

Self-insurance 232 278

Property, plant and equipment and capital leases 448 399

Capital and net operating loss carryforwards 171 172

Other 229 203

Gross deferred tax assets 1,655 1,382

Valuation allowance (165) (165)

Total deferred tax assets 1,490 1,217

Deferred tax liabilities:

Property, plant and equipment and capital leases (275) (170)

Inventories (277) (290)

Debt discount (81) (78)

Intangible assets (471) (669)

Other (39) (57)

Total deferred tax liabilities (1,143) (1,264)

Net deferred tax asset (liability) $ 347 $ (47)

The Company currently has state net operating loss (“NOL”) carryforward of $444 for tax purposes. The NOL

carryforward expires beginning in 2011 and continuing through 2027. The Company also has capital loss

carryforward which expires in fiscal 2011.

The Company records valuation allowances to reduce deferred tax assets to the amount that is more-likely-

than-not to be realized. The Company recorded a valuation allowance of $18 against a portion of its NOL

carryforward deferred tax asset and a full valuation allowance of $147 against its capital loss carryforward

deferred tax asset, as realization of the deferred tax asset in future years is uncertain. Based on the Company’s

carryback potential, reversing taxable differences, and projected future earnings, the Company has evaluated

the remaining deferred tax assets and has determined that it is more-likely-than-not that all of the deferred tax

assets will be realized.

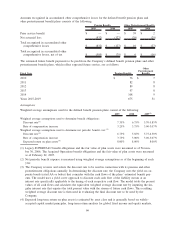

Changes in the Company’s unrecognized tax benefits during fiscal 2009 consisted of the following:

2009 2008

Beginning balance $146 $ 312

Increase based on tax positions related to the current year 5 1

Decrease based on tax positions related to the current year — (2)

Increase based on tax positions related to prior years 22 18

Decrease based on tax positions related to prior years (37) (180)

Decrease due to lapse of statute of limitations (22) (3)

Ending balance $114 $ 146

Included in the balance of unrecognized tax benefits as of February 28, 2009 and February 23, 2008 are tax

positions of $57, net of tax, and $29, net of tax, respectively, that would reduce the Company’s effective tax

rate if recognized in future periods.

60