Albertsons 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

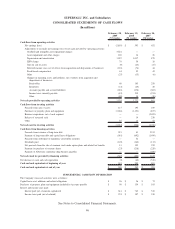

2009 2008

1.32% to 3.25% Revolving Credit Facility and Variable Rate Notes

due June 2011—June 2012 $1,920 $1,933

7.50% Notes due February 2011 700 700

7.45% Debentures due August 2029 650 650

6.10% to 7.15% Medium Term Notes due July 2009—June 2028 512 622

7.50% Notes due November 2014 500 500

8.00% Debentures due May 2031 400 400

7.875% Notes due August 2009 350 350

6.95% Notes due August 2009 350 350

7.50% Notes due May 2012 300 300

8.35% Notes due May 2010 275 275

8.00% Debentures due June 2026 272 272

8.70% Debentures due May 2030 225 225

7.75% Debentures due June 2026 200 200

7.25% Notes due May 2013 200 200

7.50% Debentures due May 2037 191 200

7.90% Debentures due May 2017 96 96

Accounts Receivable Securitization Facility, currently 1.21% 120 272

Other 97 112

Net discount on acquired debt, using an effective interest rate of 5.44% to 8.97% (208) (206)

Capital lease obligations 1,334 1,382

Total debt and capital lease obligations 8,484 8,833

Less current maturities of long-term debt and capital lease obligations (516) (331)

Long-term debt and capital lease obligations $7,968 $8,502

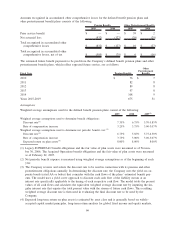

Future maturities of long-term debt other than capital lease obligations as of February 28, 2009 consist of the

following:

Fiscal Year

2010 $1,223

2011 1,121

2012 603

2013 1,390

2014 245

Thereafter 2,800

In the table above, future maturities of long-term debt exclude the net discount on acquired debt and original

issue discounts. Fiscal 2010 includes $191 of debentures that contain put options exercisable in May 2009.

Certain of the Company’s credit facilities and long-term debt agreements have restrictive covenants and cross-

default provisions which generally provide, subject to the Company’s right to cure, for the acceleration of

payments due in the event of a breach of the covenant or a default in the payment of a specified amount of

indebtedness due under certain other debt agreements. The Company was in compliance with all such

covenants and provisions for all periods presented.

The Company has senior secured credit facilities in the amount of $4,000. These facilities were provided by a

group of lenders and consist of a $2,000 five-year revolving credit facility (the “Revolving Credit Facility”), a

$750 five-year term loan (“Term Loan A”) and a $1,250 six-year term loan (“Term Loan B”). The rates in

effect on outstanding borrowings under the facilities as of February 28, 2009, based on the Company’s current

56