Albertsons 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

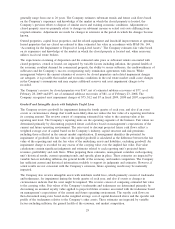

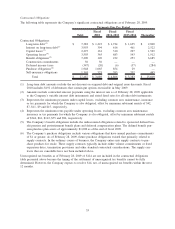

Contractual Obligations

The following table represents the Company’s significant contractual obligations as of February 28, 2009.

Total

Fiscal

2010

Fiscal

2011-2012

Fiscal

2013-2014 Thereafter

Payments Due Per Period

Contractual Obligations:

Long-term debt

(1)

$ 7,382 $ 1,223 $ 1,724 $ 1,635 $ 2,800

Interest on long-term debt

(2)

3,993 394 616 461 2,522

Capital leases

(3)

2,297 161 310 297 1,529

Operating leases

(4)

3,503 365 683 543 1,912

Benefit obligations

(5)

7,290 120 232 253 6,685

Construction commitments 56 56 — — —

Deferred income taxes (347) (20) (6) (37) (284)

Purchase obligations

(6)

1,948 1,065 854 29 —

Self-insurance obligations 1,365 325 393 202 445

Total $ 27,487 $ 3,689 $ 4,806 $ 3,383 $ 15,609

(1) Long-term debt amounts exclude the net discount on acquired debt and original issue discounts. Fiscal

2010 includes $191 of debentures that contain put options exercisable in May 2009.

(2) Amounts include contractual interest payments using the interest rate as of February 28, 2009 applicable

to the Company’s variable interest debt instruments and stated fixed rates for all other debt instruments.

(3) Represents the minimum payments under capital leases, excluding common area maintenance, insurance

or tax payments for which the Company is also obligated, offset by minimum subtenant rentals of $42,

$7, $11, $9 and $15, respectively.

(4) Represents the minimum rents payable under operating leases, excluding common area maintenance,

insurance or tax payments for which the Company is also obligated, offset by minimum subtenant rentals

of $344, $61, $112, $75 and $96, respectively.

(5) The Company’s benefit obligations include the undiscounted obligations related to sponsored defined ben-

efit pension and postretirement benefit plans and deferred compensation plans. The defined benefit pen-

sion plan has plan assets of approximately $1,008 as of the end of fiscal 2009.

(6) The Company’s purchase obligations include various obligations that have annual purchase commitments

of $1 or greater. As of February 28, 2009, future purchase obligations existed that primarily related to

supply contracts. In the ordinary course of business, the Company enters into supply contracts to pur-

chase products for resale. These supply contracts typically include either volume commitments or fixed

expiration dates, termination provisions and other standard contractual considerations. The supply con-

tracts that are cancelable have not been included above.

Unrecognized tax benefits as of February 28, 2009 of $114 are not included in the contractual obligations

table presented above because the timing of the settlement of unrecognized tax benefits cannot be fully

determined. However, the Company expects to resolve $14, net, of unrecognized tax benefits within the next

12 months.

35