Albertsons 2009 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2009 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

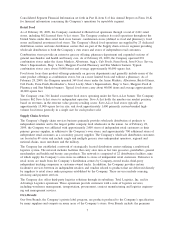

Net Sales

Retail

Supply Chain

Total Net Sales

52 Weeks Ended

February 23, 2008

53 Weeks Ended

February 28, 2009

Net Earnings (Loss)

Net Earnings (Loss) Per Diluted Share

Impairment and Other Charges per Share(1)

Adjusted Net Earnings Per Diluted Share(2)

Financial Highlights

(In Millions except per share data)

($2,855)

($13.51)

$16.40

$2.89

$593

$2.76

$0.21

$2.97

$1,550

$274

$1,684

$73

$1,757

($2,315)

$307

($2,157)

$3,762

$1,605

Operating Earnings (Loss)

Retail

Supply Chain

Total Operating Earnings (Loss)

Impairment and Other Charges(1)

Adjusted Operating Earnings(2)

$34,341

$9,707

$44,048

$34,664

$9,900

$44,564

Net Sales (In Billions)

2008 2009

$44.0

$44.6

34.3

9.7

34.7

9.9

Total Debt

(In Billions)

2008 2009

$8.833 $8.484

Adjusted Diluted

Earnings per Share

2008 2009

$2.97

$2.89

Supply Chain

Retail

(2)

Our mission at SUPERVALU always will

be to serve our customers better than anyone

else could serve them. We will provide our cus-

tomers with value through our products and

services, committing ourselves to providing

the quality, variety and convenience they ex-

pect.

Our success requires us to trust in our employ-

ees, respect their individual contributions and

make a commitment to their continued devel-

opment. This environment will allow us to at-

tract the best people and provide opportuni-

ties through which they can achieve personal

and professional satisfaction. We will strive to

be the best place to work in the industry.

Our commitment is to support the communi-

ties in which our employees and customers live

and work. We will use our time and resources

to preserve our role as a partner, neighbor and

friend.

Our responsibility to our investors is clear - con-

tinuous profit growth while ensuring our future

success. SUPERVALU will prosper through a

balance of innovation and good business de-

cisions that enhances our operations and cre-

ates superior value for our customers. Through

these actions, we will be the best place to in-

vest in our industry.

By pursuing these goals, SUPERVALU will

continue to build on our foundation as a

world-class retailer and distributor that values

long-standing ties with its constituents, and

conducts its business with integrity and ethics.

We will continue to foster strong relationships

with the diverse people and organizations with

whom we work. Through open communication

with our customers, employees, communities

and shareholders, we will adapt to changing

times while holding true to the fundamentals

that support both our growth and stability.

We shall pursue our mission with a passion for

what we do and a focus on priorities that will

truly make a difference in our future.

(1) Fiscal 2008 included one-time acquisition-related costs ($73 million pre-tax

or $0.21 per share); Fiscal 2009 charges included impairment charges required

by Statement of Financial Accounting Standards No. 142, “Goodwill and

Other Intangible Assets” ($3,524 million pre-tax or $15.71 per share), costs

related primarily to store closures ($200 million pre-tax or $0.58 per share),

settlement costs related to a pre-acquisition Albertsons litigation matter ($24

million pre-tax or $0.07 per share), and one-time acquisition-related costs ($14

million pre-tax or $0.04 per share).

(2) Comparison of GAAP to Non-GAAP Adjusted Financial Measures. The

Non-GAAP adjusted operating earnings and adjusted net earnings per di-

luted share are provided to assist in understanding the impact of the impair-

ment and other charges on actual results when compared with prior periods.

We believe that adjusting for the impairment and other charges will assist

investors in making an evaluation of our performance. This information should

not be construed as an alternative to the reported results, which have been

determined in accordance with accounting principles generally accepted in

the United States of America.