Albertsons 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

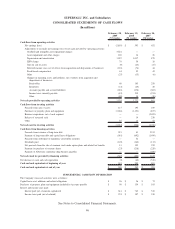

SUPERVALU INC. and Subsidiaries

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In millions, except per share data)

Common

Stock

Capital in

Excess

of Par

Value

Treasury

Stock

Accumulated

Other

Comprehensive

Losses

Retained

Earnings

Total

Stockholders’

Equity

Comprehensive

Income (Loss)

Balances as of February 25, 2006 $ 151 $ 132 $ (313) $ (128) $ 2,777 $ 2,619

Net earnings — — — — 452 452 $ 452

Pension and other postretirement activity (net

of tax of $71 and $17, respectively) — — — (107) — (107) (26)

Stock, options and restricted stock units

issued in connection with acquisition of

New Albertsons 69 2,327 — — — 2,396 —

Sales of common stock under option plans 8 221 30 — — 259 —

Cash dividends declared on common stock

$0.6575 per share — — — — (126) (126) —

Compensation under employee incentive

plans 1 28 4 — — 33 —

Purchase of shares for treasury — — (220) — — (220) —

Balances as of February 24, 2007 229 2,708 (499) (235) 3,103 5,306 $ 426

Effects of changing pension plan

measurement date pursuant to

SFAS No. 158 (net of tax of $20 and $7,

respectively) — — — 32 (10) 22

Beginning balance, as adjusted 229 2,708 (499) (203) 3,093 5,328

Net earnings — — — — 593 593 $ 593

Pension and other postretirement activity (net

of tax of $70) — — — 108 — 108 108

Sales of common stock under option plans — 3 141 — — 144 —

Cash dividends declared on common stock

$0.6750 per share — — — — (143) (143) —

Compensation under employee incentive

plans — 49 (4) — — 45 —

Shares issued in settlement of zero-coupon

convertible debentures and mandatory

convertible securities 1 62 33 — — 96 —

Purchase of shares for treasury — — (218) — — (218) —

Balances as of February 23, 2008 230 2,822 (547) (95) 3,543 5,953 $ 701

Net loss — — — — (2,855) (2,855) $ (2,855)

Pension and other postretirement activity (net

of tax of $261) (408) — (408) (408)

Sales of common stock under option plans — 2 12 — — 14 —

Cash dividends declared on common stock

$0.6875 per share — — — — (146) (146) —

Compensation under employee incentive

plans — 29 17 — — 46 —

Purchase of share for treasury — — (23) — — (23) —

Balances as of February 28, 2009 $ 230 $ 2,853 $ (541) $ (503) $ 542 $ 2,581 $ (3,263)

See Notes to Consolidated Financial Statements.

45