Albertsons 2009 Annual Report Download - page 29

Download and view the complete annual report

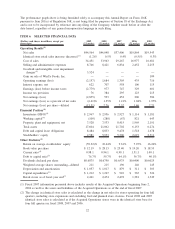

Please find page 29 of the 2009 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Retail food sales for fiscal 2009 were $34,664, compared with $34,341 last year, primarily reflecting the extra

week of sales of approximately $578 in fiscal 2009, partially offset by the impact of store closures and

negative identical store retail sales growth (defined as stores operating for four full quarters, including store

expansions and excluding fuel and planned store closures). For fiscal 2009, as compared to fiscal 2008,

identical store retail sales growth was negative 1.2 percent based on the same 52-week period for both years,

as a result of a soft sales environment and higher levels of competitive activity.

During fiscal 2009, the Company added 44 new stores through new store development and closed 97 stores.

Total retail square footage as of the end of fiscal 2009 was approximately 69 million, a decrease of 2.8 percent

from the end of fiscal 2008. Total retail square footage, excluding store closures, increased 1.4 percent from

the end of fiscal 2008.

Supply chain services sales for fiscal 2009 were $9,900, compared with $9,707 last year, primarily reflecting

the extra week of sales of approximately $165 in fiscal 2009 as well as the pass through of inflation and new

business growth, partially offset by the on-going transition of a national retailer’s volume to self distribution.

Gross Profit

Gross profit, as a percent of Net sales, was 22.7 percent for fiscal 2009 compared with 22.9 percent last year.

The decrease is primarily attributable to investments in price and higher levels of promotional spending, higher

LIFO charges and inventory valuation charges, partially offset by lower shrink.

Selling and Administrative Expenses

Selling and administrative expenses, as a percent of Net sales, were 19.6 percent for fiscal 2009, compared

with 19.1 percent last year. The increase in Selling and administrative expenses, as a percent of Net sales, is

attributable to charges primarily related to the closure of non-strategic stores in the fourth quarter of fiscal

2009, higher employee-related costs and higher occupancy costs, partially offset by lower Acquisition-related

costs.

Goodwill and intangible asset impairment charges

In accordance with Statement of Financial Accounting Standards (“SFAS”) No. 142, “Goodwill and Other

Intangible Assets,” the Company applies a fair value-based impairment test to the net book value of goodwill

and indefinite-lived intangible assets on an annual basis and on an interim basis if certain events or

circumstances indicate that an impairment loss may have occurred. For the third quarter of fiscal 2009, the

Company’s stock price had a significant and sustained decline and book value per share substantially exceeded

the stock price. Consistent with SFAS No. 142, the Company recorded impairment charges of $3,524,

comprised of $3,223 to goodwill at certain Retail food reporting units and $301 to indefinite-lived trademarks

and tradenames related to the Acquired Trademarks and other intangible assets. The impairment of goodwill

and indefinite-lived intangible assets reflects the significant decline in the market price of the Company’s

common stock as of the end of the third quarter of fiscal 2009 as well as the impact of the unprecedented

decline in the economy on the Company’s plan.

Operating Earnings (Loss)

Operating loss for fiscal 2009 was $2,157, compared with operating earnings of $1,684 last year. Retail food

operating loss for fiscal 2009 was $2,315, compared with operating earnings of $1,550 last year, reflecting

$3,524 of goodwill and intangible asset impairment charges and $162 of charges primarily related to the

closure of non-strategic stores with the remaining decrease of $179, or 52 basis points, attributable to

investments in price, higher promotional spending, higher employee-related costs and higher occupancy costs.

Supply chain services operating earnings for fiscal 2009 were $307, or 3.1 percent of Supply chain services

net sales, compared with $274, or 2.8 percent of Supply chain services net sales last year, primarily reflecting

improved sales leverage and cost reduction initiatives.

Net Interest Expense

Net interest expense was $622 in fiscal 2009, compared with $707 last year, primarily reflecting lower debt

levels and the benefit of lower borrowing rates on floating rate debt in fiscal 2009.

25