Albertsons 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

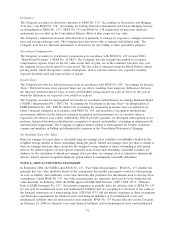

from five to 20 years. Future minimum lease and subtenant rentals under noncancellable leases as of

February 28, 2009 consist of the following:

Fiscal Year

Operating

Leases

Direct

Financing

Leases

Lease Receipts

2010 $24 $6

2011 22 5

2012 19 5

2013 18 4

2014 10 4

Thereafter 24 14

Total minimum lease receipts $117 38

Less unearned income (9)

Net investment in direct financing leases 29

Less current portion (4)

Long-term portion $25

The carrying value of owned property leased to third parties under operating leases was as follows:

2009 2008

Property, plant and equipment $22 $24

Less accumulated depreciation (5) (5)

Property, plant and equipment, net $17 $19

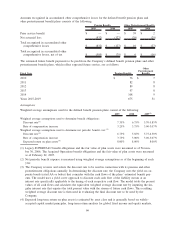

NOTE 9—INCOME TAXES

The provision for income taxes consisted of the following:

2009 2008 2007

Current

Federal $ 148 $396 $185

State 46 63 38

Total current 194 459 223

Deferred (118) (75) 72

Total provision $ 76 $384 $295

The difference between the actual tax provision and the tax provision computed by applying the statutory

federal income tax rate to earnings (losses) before income taxes is attributable to the following:

2009 2008 2007

Federal taxes based on statutory rate $ (973) $342 $261

State income taxes, net of federal benefit (7) 40 31

Goodwill impairment 1,060 — —

Other (4) 2 3

Total provision $ 76 $384 $295

59