3M 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

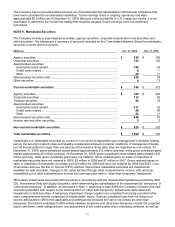

the factors included in the impairment model for debt securities included in the new standard relating to “other-than

temporary” impairments, as described in Note 1.

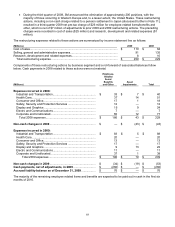

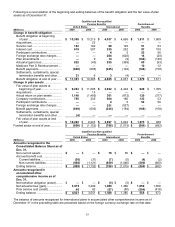

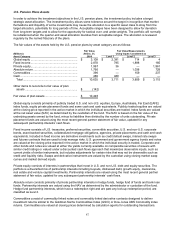

The balance at December 31, 2009 for marketable securities and short-term investments by contractual maturity are

shown below. Actual maturities may differ from contractual maturities because the issuers of the securities may have

the right to prepay obligations without prepayment penalties.

(Millions) Dec. 31, 2009

Due in one year or less ........................................................................................................................

.

$ 487

Due after one year through three years ...............................................................................................

.

960

Due after three years through five years..............................................................................................

.

88

Due after five years ..............................................................................................................................

.

34

Total marketable securities ..................................................................................................................

.

$ 1,569

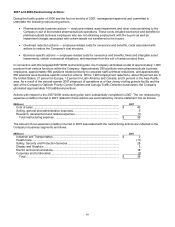

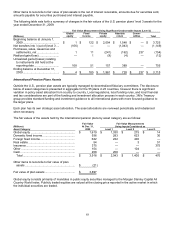

3M has a diversified marketable securities portfolio of $1.569 billion as of December 31, 2009. Within this portfolio,

current and long-term asset-backed securities (estimated fair value of $705 million) are primarily comprised of

interests in automobile loans and credit cards. At December 31, 2009, the asset-backed securities credit ratings were

AAA or A-1+, with the exception of three securities rated AA with a fair market value of less than $12 million, and one

security rated A with a fair market value of less than $1 million.

Historically, 3M’s marketable securities portfolio included auction rate securities that represented interests in

investment grade credit default swaps; however, the estimated fair value of auction rate securities are $5 million and

$1 million as of December 31, 2009 and December 31, 2008, respectively. Gross unrealized losses within

accumulated other comprehensive income related to auction rate securities totaled $8 million and $16 million (pre-

tax) as of December 31, 2009 and December 31, 2008, respectively. As of December 31, 2009, auction rate

securities associated with these balances have been in a loss position for more than 12 months. Since the second

half of 2007, these auction rate securities failed to auction due to sell orders exceeding buy orders. Liquidity for these

auction-rate securities is typically provided by an auction process that resets the applicable interest rate at pre-

determined intervals, usually every 7, 28, 35, or 90 days. The funds associated with failed auctions will not be

accessible until a successful auction occurs or a buyer is found outside of the auction process. 3M recorded “other-

than-temporary” impairment charges associated with these auction rate securities that reduced pre-tax income by

approximately $9 million in 2008 and $8 million 2007. In addition, 3M recognized a loss in 2009 when it reclassified

an unrealized loss of $2 million from other comprehensive income in connection with the sale of its position in one of

these auction rate securities. Refer to Note 13 for a table that reconciles the beginning and ending balances of

auction rate securities.