3M 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

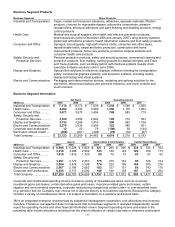

116

assets. However, the separate amounts stated for segment depreciation, amortization, and capital expenditures are

based on secondary performance measures used by management that do not include allocations of certain corporate

items.

Segment assets for the operating business segments (excluding Corporate and Unallocated) primarily include

accounts receivable; inventory; property, plant and equipment — net; goodwill and intangible assets; and other

miscellaneous assets. Assets included in Corporate and Unallocated principally are cash, cash equivalents and

marketable securities; insurance receivables; deferred income taxes; certain investments and other assets, including

prepaid pension assets. Corporate and unallocated assets can change from year to year due to changes in cash,

cash equivalents and marketable securities, changes in prepaid pension benefits, and changes in other unallocated

asset categories.

The most significant items impacting 2009 and 2008 results were restructuring actions and exit activities. The most

significant items impacting 2007 results are the net gain on sale of the pharmaceuticals business (within the Health

Care segment) and restructuring and other actions. Refer to Note 4 for discussion of restructuring actions and exit

activities and Note 2 for discussion of divestitures.

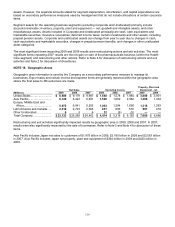

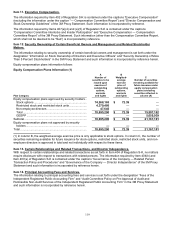

NOTE 18. Geographic Areas

Geographic area information is used by the Company as a secondary performance measure to manage its

businesses. Export sales and certain income and expense items are generally reported within the geographic area

where the final sales to 3M customers are made.

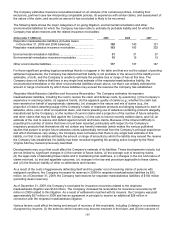

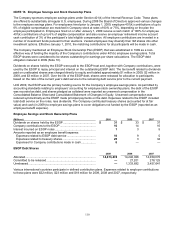

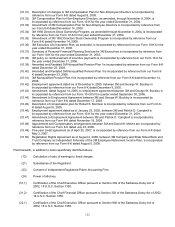

Net Sales Operating Income

Property, Plant and

Equipment - net

(Millions) 2009 2008 2007 2009 2008 2007 2009 2008

United States.......................... $ 8,509 $ 9,179 $ 8,987 $ 1,640 $ 1,578 $ 1,894 $ 3,809 $ 3,901

Asia Pacific............................. 6,120 6,423 6,601 1,528 1,662 2,062 1,366 1,304

Europe, Middle East and

Africa................................... 5,972 6,941 6,503 1,003 1,294 1,626 1,318 1,263

Latin America and Canada..... 2,516 2,723 2,365 631 693 616 507 418

Other Unallocated .................. 6

3 6 12 (9) (5) — —

Total Company ....................... $ 23,123 $ 25,269 $ 24,462 $ 4,814 $ 5,218 $ 6,193 $ 7,000 $ 6,886

Restructuring and exit activities significantly impacted results by geographic area in 2009, 2008 and 2007. In 2007,

results were also significantly impacted by the sale of businesses. Refer to Note 2 and Note 4 for discussion of these

items.

Asia Pacific includes Japan net sales to customers of $1.979 billion in 2009, $2.180 billion in 2008 and $2.063 billion

in 2007. Asia Pacific includes Japan net property, plant and equipment of $364 million in 2009 and $420 million in

2008.