3M 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

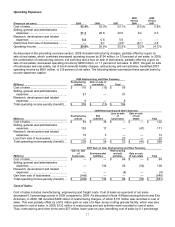

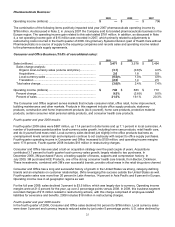

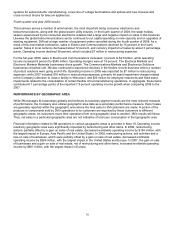

Full-year 2009 sales in Safety, Security and Protection Services totaled $3.2 billion, down 7.8 percent in dollar-terms

and 2.7 percent in local currencies. 3M drove positive local-currency growth in personal protection products, but all

other businesses posted declines for the full year. The global economic downturn negatively impacted the industrial

and construction-related businesses within this segment.

Despite the near 8 percent sales decline for the year, operating income margins rose to 23.4 percent. In 2009, this

business segment recorded charges of $17 million related to restructuring actions, comprised of employee-related

liabilities for severance and benefits. This charge was partially offset by a gain of $15 million related to the sale of

3M’s New Jersey roofing granule facility. In the second quarter of 2008, 3M completed the sale of its HighJump

Software business and recognized a pre-tax loss of $23 million. In addition, 3M recorded restructuring charges and

exit activities that totaled $15 million in 2008.

In June 2009, 3M’s Security Systems Division was notified that the UK government decided to award its passport

production to a competitor upon the expiration of 3M’s existing UK passport contract in October 2010. 3M remains

confident in the future of this business, and the growth prospects remain strong. 3M continues to aggressively work

to win additional contracts in other countries. Refer to “Critical Accounting Estimates” within “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” for additional discussion.

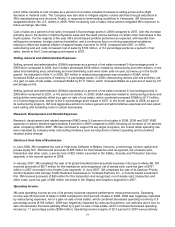

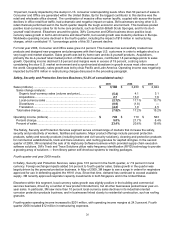

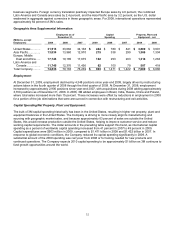

Fourth quarter and year 2008 results:

In the fourth quarter of 2008, sales in this business rose 1.0 percent to $729 million. Local-currency sales increased

11.5 percent, driven by 3M’s 2008 acquisition of Aearo Technologies. Acquisitions contributed 14.4 percentage

points of growth in the fourth quarter. On a geographic basis, sales for the quarter were strongest in the United

States, followed by the Asia Pacific region. Operating income in the fourth quarter declined 10.5 percent, which

included $12 million in restructuring expenses.

Full-year 2008 sales increased 17.2 percent. In local-currency terms, sales rose approximately 17 percent,

comprised of 13 points from acquisitions and 2 points each from organic volumes and selling price increases. Sales

growth was led by acquisitions, primarily Aearo, along with organic growth in personal protection solutions, cleaning

and protection solutions for commercial buildings, and RFID solutions (Track and Trace). Aearo, acquired in

April 2008, manufactures and sells personal protection and energy absorbing products. Aearo expanded 3M’s

platform by adding hearing protection as well as eyewear and fall protection product lines to 3M’s existing line of

respiratory products. In July 2008, 3M acquired Quest Technologies Inc., a manufacturer of environmental monitoring

equipment, including noise, heat stress and vibration monitors. The sale of HighJump Software (discussed below)

resulted in a 1.8 percentage point penalty to full-year sales. Worldwide operating income was up 21.7 percent to

$710 million.

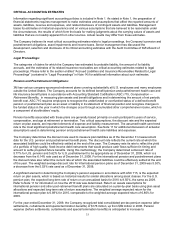

In 2008, 3M announced and completed the sale of its HighJump Software business and recognized a pre-tax loss of

$23 million in the second quarter of 2008. In addition, 3M recorded restructuring charges and exit activities that

totaled $15 million in 2008. Including the preceding 2008 items, operating income margins were in excess of 20

percent for 2008. In the second quarter of 2007, 3M recorded a restructuring charge of $29 million related to the

phaseout of operations at its New Jersey roofing granule facility. This included fixed asset impairments and

employee-related restructuring liabilities.

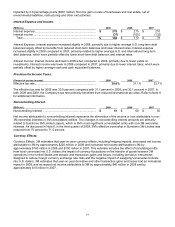

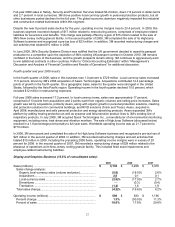

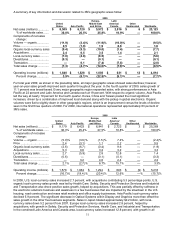

Display and Graphics Business (13.5% of consolidated sales):

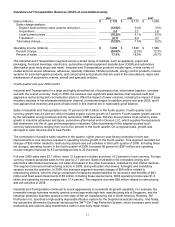

2009 2008 2007

Sales (millions) ............................................................................... $ 3,132 $ 3,268 $ 3,916

Sales change analysis:

Organic local-currency sales (volume and price).................... (5.6) (18.0)% 2.6%

Acquisitions ............................................................................. 2.8 0.1 0.1

Local-currency sales ............................................................... (2.8)% (17.9)% 2.7%

Divestitures .............................................................................

—

(0.3) (0.4)

Translation .............................................................................. (1.4) 1.6 1.9

Total sales change...................................................................... (4.2)% (16.6)% 4.2%

Operating income (millions) ........................................................... $ 590 $ 583 $ 1,166

Percent change........................................................................... 1.3% (50.0)% 11.3%

Percent of sales .......................................................................... 18.8% 17.8% 29.8%