3M 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

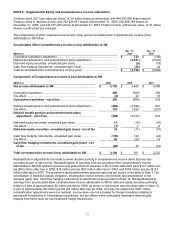

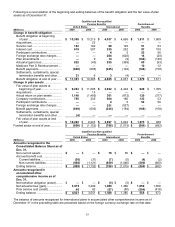

NOTE 6. Supplemental Equity and Comprehensive Income Information

Common stock ($.01 par value per share) of 3.0 billion shares is authorized, with 944,033,056 shares issued.

Treasury stock is reported at cost, with 233,433,937 shares at December 31, 2009, 250,489,769 shares at

December 31, 2008, and 234,877,025 shares at December 31, 2007. Preferred stock, without par value, of 10 million

shares is authorized but unissued.

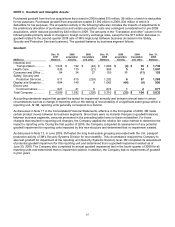

The components of other comprehensive income (loss) and accumulated other comprehensive income (loss)

attributable to 3M follow.

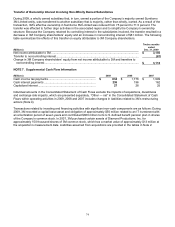

Accumulated Other Comprehensive Income (Loss) Attributable to 3M

(Millions)

Dec. 31,

2009

Dec. 31,

2008

Cumulative translation adjustment............................................................................

.

$ 122 $ (146)

Defined benefit pension and postretirement plans adjustment.................................

.

(3,831) (3,525)

Debt and equity securities, unrealized gain (loss) ....................................................

.

(9) (19)

Cash flow hedging instruments, unrealized gain (loss).............................................

.

(36) 44

Total accumulated other comprehensive income (loss)............................................

.

$ (3,754) $ (3,646)

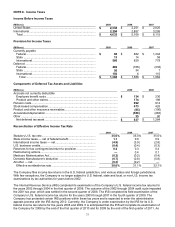

Components of Comprehensive Income (Loss) Attributable to 3M

(Millions) 2009 2008 2007

Net income attributable to 3M..................................................... $ 3,193 $ 3,460 $ 4,096

Cumulative translation.................................................................... 288 (920) 456

Tax effect........................................................................................ (2) 32 76

Cumulative translation - net of tax ............................................. 286 (888) 532

Defined benefit pension and postretirement plans adjustment...... (462) (3,096) 941

Tax effect........................................................................................ 153 1,024 (327)

Defined benefit pension and postretirement plans

adjustment - net of tax ............................................................. (309) (2,072) 614

Debt and equity securities, unrealized gain (loss) ......................... 17 (18) (16)

Tax effect........................................................................................ (7) 7 6

Debt and equity securities, unrealized gain (loss) - net of tax 10 (11) (10)

Cash flow hedging instruments, unrealized gain (loss).................. (130) 124 (24)

Tax effect........................................................................................ 50 (52) 14

Cash flow hedging instruments, unrealized gain (loss) - net

of tax .......................................................................................... (80) 72 (10)

Total comprehensive income (loss) attributable to 3M............ $ 3,100 $ 561 $ 5,222

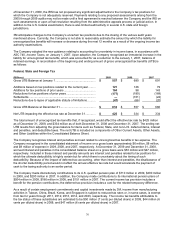

Reclassification adjustments are made to avoid double counting in comprehensive income items that are also

recorded as part of net income. Reclassifications to earnings from accumulated other comprehensive income

attributable to 3M that related to pension and postretirement expense in the income statement were $141 million pre-

tax ($92 million after-tax) in 2009, $79 million pre-tax ($52 million after-tax) in 2008, and $198 million pre-tax ($123

million after-tax) in 2007. These pension and postretirement expense amounts are shown in the table in Note 11 as

amortization of transition (asset) obligation, amortization of prior service cost (benefit) and amortization of net

actuarial (gain) loss. Cash flow hedging instruments reclassifications are provided in Note 12. Reclassifications to

earnings from accumulated other comprehensive income attributable to 3M for debt and equity securities primarily

relate to a loss of approximately $2 million pre-tax for 2009, as shown in the auction rate securities table in Note 13,

a loss of approximately $6 million pre-tax ($4 million after tax) for 2008, and was not material for 2007. Other

reclassification adjustments were not material. Income taxes are not provided for foreign translation relating to

permanent investments in international subsidiaries, but tax effects within cumulative translation does include

impacts from items such as net investment hedge transactions.