3M 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 34

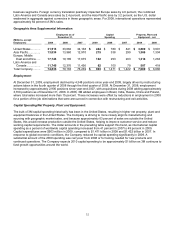

approximately $300 million in 2010. For the pension plans, holding all other factors constant, an increase/decrease in

the expected long-term rate of return on plan assets of 0.25 of a percentage point would decrease/increase 2010

pension expense by approximately $27 million for U.S. pension plans and approximately $10 million for international

pension plans. Also, holding all other factors constant, an increase/decrease in the discount rate used to measure

plan liabilities of 0.25 of a percentage point would decrease/increase 2010 pension expense by approximately $33

million for U.S. pension plans and approximately $17 million for international pension plans. See Note 11 for details

of the impact of a one percentage point change in assumed health care trend rates on the postretirement health care

benefit expense and obligation.

Asset Impairments:

As of December 31, 2009, net property, plant and equipment totaled $7.0 billion and net identifiable intangible assets

totaled $1.3 billion. Management makes estimates and assumptions in preparing the consolidated financial

statements for which actual results will emerge over long periods of time. This includes the recoverability of long-lived

assets employed in the business, including assets of acquired businesses. These estimates and assumptions are

closely monitored by management and periodically adjusted as circumstances warrant. For instance, expected asset

lives may be shortened or an impairment recorded based on a change in the expected use of the asset or

performance of the related asset group. Impairments recorded in 2009, 2008 and 2007 related to restructuring

actions and other exit activities are discussed in Note 4.

In June 2009, 3M’s Security Systems Division (within the Safety, Security and Protection Services business

segment) was notified that the UK government decided to award the production of its passports to a competitor upon

the expiration of 3M’s existing UK passport contracts in October 2010. 3M remains confident in the future of its

overall passport business, and the growth prospects remain strong. 3M continues to aggressively work to win

additional contracts in other countries. However, as a result of this event, in June 2009, 3M tested the long lived

assets associated with the UK passport activity for recoverability and also reassessed their remaining useful lives. In

addition, 3M tested goodwill for impairment at the reporting unit (Security Systems Division) level.

The result of the June 2009 test of recoverability of long lived assets associated with the UK passport activity

indicated that the asset grouping’s carrying amount of approximately $54 million (before impairment) exceeded the

remaining expected cash flows. Accordingly, 3M recorded a non-cash impairment charge of approximately $13

million in the second quarter of 2009 to write these assets down to their fair value. In addition, accelerated

depreciation/amortization is being taken over the period June 2009 through the date of expiration of the contract

based on a reassessment of the remaining expected useful life of these assets.

3M goodwill totaled approximately $5.8 billion as of December 31, 2009, which, based on impairment testing, is not

impaired. Impairment testing for goodwill is done at a reporting unit level, with all goodwill assigned to a reporting

unit. Reporting units are one level below the business segment level (3M has six business segments at

December 31, 2009), but can be combined when reporting units within the same segment have similar economic

characteristics. At 3M, reporting units generally correspond to a division. As of December 31, 2009, 3M did not

combine any of its reporting units for impairment testing.

An impairment loss generally would be recognized when the carrying amount of the reporting unit’s net assets

exceeds the estimated fair value of the reporting unit. The estimated fair value of a reporting unit is determined using

earnings for the reporting unit multiplied by a price/earnings ratio for comparable industry groups, or by using a

discounted cash flow analysis. 3M typically uses the price/earnings ratio approach for stable and growing businesses

that have a long history and track record of generating positive operating income and cash flows. 3M uses the

discounted cash flow approach for start-up, loss position and declining businesses, but also uses discounted cash

flow as an additional tool for businesses that may be growing at a slower rate than planned due to economic or other

conditions. 3M completes its annual impairment tests in the fourth quarter of each year.

As of December 31, 2009, 3M had 37 primary reporting units, with eight reporting units accounting for approximately

75 percent of the goodwill. These eight reporting units were comprised of the following divisions: 3M Purification Inc.,

Occupational Health and Environmental Safety, Optical Systems, 3M ESPE, Communication Markets, Industrial

Adhesives and Tapes, Security Systems, and Health Information Systems.

The fair values for the majority of reporting units were in excess of carrying value by more than 30 percent. The fair

values for 3M Purification Inc., Optical Systems and Security Systems, based on fourth quarter 2009 testing, were in

excess of carrying value by approximately 15 percent to 30 percent, with no impairment indicated. As part of its

annual impairment testing in the fourth quarter, 3M used a weighted-average discounted cash flow analysis for its 3M

Purification Inc., Optical Systems and Security Systems divisions, using projected cash flows that were weighted