3M 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 15

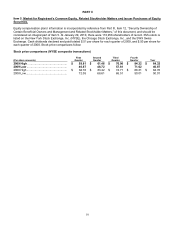

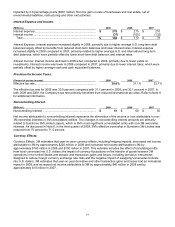

activity was suspended beginning in the fourth quarter of 2008. The extension of this program provides flexibility to

resume repurchase activity when business conditions permit. In 2009 no broker repurchases of stock were made,

compared to repurchases of 3M common stock of $1.6 billion in 2008 (primarily in the first nine months of 2008) and

repurchases of 3M common stock of $3.2 billion in 2007. In February 2010, 3M’s Board of Directors authorized a

dividend increase of 2.9 percent for 2010, marking the 52nd consecutive year of dividend increases for 3M. 3M’s

debt to total capital ratio (total capital defined as debt plus equity) at December 31, 2009 was 30 percent, compared

to 39 percent at December 31, 2008. A portion of the increase in debt at year-end 2008 was the result of a strategy

to build and maintain a cash buffer in the U.S. given the difficult market environment at that point in time. 3M has an

AA- credit rating with a stable outlook from Standard & Poor’s and an Aa2 credit rating with a stable outlook from

Moody’s Investors Service. In addition to cash on hand, the Company has sufficient access to capital markets to

meet currently anticipated growth and acquisition investment funding needs.

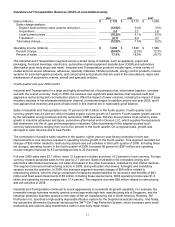

In 2009, the Company experienced cost decreases in most raw materials and transportation fuel costs. This was

driven by lower basic feedstock costs, particularly metals and oil derived materials. To date the Company is receiving

sufficient quantities of all raw materials to meet its reasonably foreseeable production requirements. It is impossible

to predict future shortages of raw materials or the impact any such shortages would have. 3M has avoided disruption

to its manufacturing operations through careful management of existing raw material inventories and development

and qualification of additional supply sources. 3M manages commodity price risks through negotiated supply

contracts, price protection agreements and forward physical contracts.

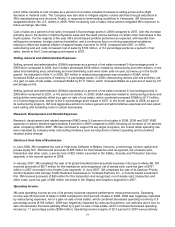

In 2009, 3M changed its annual stock option and restricted stock unit grant date to more closely align the award with

the timing of the Company’s performance review process. In 2009 and forward, under the annual grant, 3M will grant

shares in February instead of May as in previous years. Accounting rules requires recognition of expense under a

non-substantive vesting period approach, requiring compensation expense recognition when an employee is eligible

to retire. 3M employees in the United States are eligible to retire at age 55 and after having completed five years of

service. Approximately 25 percent of the stock-based compensation award expense dollars are for this retiree-

eligible population. Therefore, in 2007 and 2008, the second quarter of each year (because of the May grant date)

reflected higher stock-based compensation expense than the other quarters. In 2009, the retiree-eligible impact

shifted to the first quarter of 2009. In addition, both the first and second quarter of 2009 reflected higher stock-based

compensation expense related to the earlier February grant date. These and other factors resulted in higher stock-

based compensation cost in 2009 when compared to 2008. Refer to Note 16 for additional discussion of the

Company’s stock-based compensation programs.

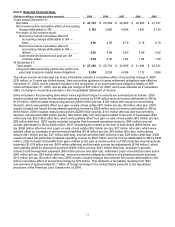

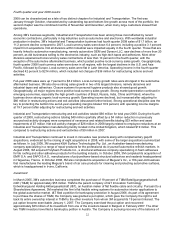

3M’s pension plans were 90 percent funded at year-end 2009. The U.S. qualified plan, which is approximately 68

percent of the worldwide pension obligation, was 96 percent funded, and the international plans were 83 percent

funded. Asset returns in 2009 for the U.S. qualified plan were 12.6 percent while the year-end 2009 discount rate

was 5.77%, down 0.37 percentage points from the 2008 discount rate of 6.14%. 3M expects to contribute $500

million to $700 million of cash to its global pension plans in 2010. The Company does not have a required minimum

pension contribution obligation for its U.S. plans in 2010. 3M expects pension and postretirement benefit expense in

2010 to increase by approximately $130 million pre-tax, or 12 cents per diluted share, when compared to 2009. Refer

to critical accounting estimates within MD&A and Note 11 (Pension and Postretirement Benefit Plans) for additional

information concerning 3M’s pension and post-retirement plans.

The preceding forward-looking statements involve risks and uncertainties that could cause results to differ materially

from those projected (refer to the forward-looking statements section in Item 7 and the risk factors provided in Item

1A for discussion of these risks and uncertainties).

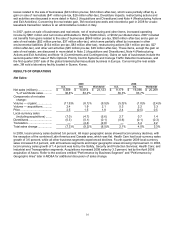

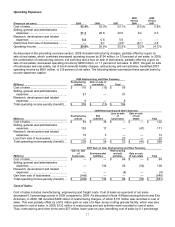

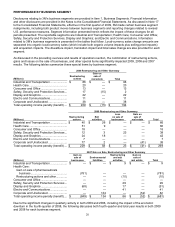

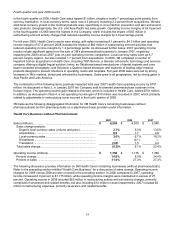

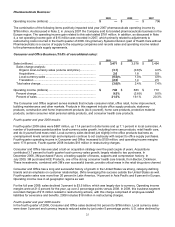

Special Items:

Special items represent significant charges or credits that are important to understanding changes in the Company’s

underlying operations.

In 2009, net losses for restructuring and other actions decreased operating income by $194 million and net income

attributable to 3M by $119 million, or $0.17 per diluted share. 2009 included restructuring actions ($209 million pre-

tax, $128 million after tax and noncontrolling interest), which were partially offset by a gain on sale of real estate ($15

million pre-tax, $9 million after tax). The gain on sale of real estate relates to the June 2009 sale of a New Jersey

roofing granule facility, which is recorded in cost of sales within the Safety, Security and Protection Services business

segment. Restructuring is discussed in more detail in Note 4 (Restructuring Actions and Exit Activities).

In 2008, net losses for restructuring and other actions decreased operating income by $269 million and net income

attributable to 3M by $194 million, or $0.28 per diluted share. 2008 included restructuring actions ($229 million pre-

tax, $147 million after-tax and noncontrolling interest), exit activities ($58 million pre-tax, $43 million after-tax) and