3M 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

impacted by 2.8 percentage points ($681 million) from the gain on sale of businesses and real estate, net of

environmental liabilities, restructuring and other exit activities.

Interest Expense and Income:

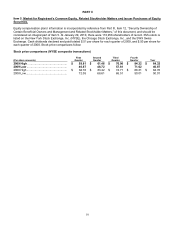

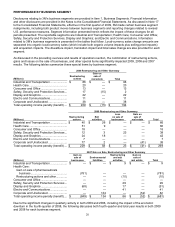

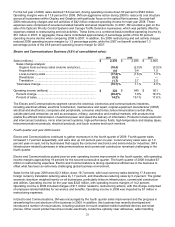

(Millions) 2009 2008 2007

Interest expense............................................................................. $ 219 $ 215 $ 210

Interest income............................................................................... (37) (105) (132)

Total............................................................................................ $ 182 $ 110 $ 78

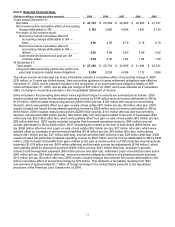

Interest Expense: Interest expense increased slightly in 2009, primarily due to higher average U.S. long-term debt

balances largely offset by benefits from reduced short-term balances and lower interest rates. Interest expense

increased slightly in 2008 compared to 2007, primarily related to higher average U.S. and international long-term

debt balances, which were partially offset by lower short-term debt balances and interest rates.

Interest Income: Interest income declined in 2009 when compared to 2008, primarily due to lower yields on

investments. Interest income was lower in 2008 compared to 2007, primarily due to lower interest rates, which were

partially offset by higher average cash and cash equivalent balances.

Provision for Income Taxes:

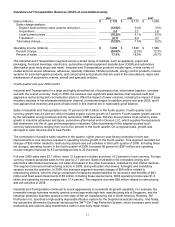

(Percent of pre-tax income) 2009 2008 2007

Effective tax rate............................................................................. 30.0% 31.1% 32.1

%

The effective tax rate for 2009 was 30.0 percent, compared with 31.1 percent in 2008, and 32.1 percent in 2007. In

both 2009 and 2008, the Company’s tax rate primarily benefited from reduced international tax rates. Refer to Note 8

for additional information.

Noncontrolling Interest:

(Millions) 2009 2008 2007

Noncontrolling interest ................................................................... $51

$ 60 $ 55

Net income attributable to noncontrolling interest represents the elimination of the income or loss attributable to non-

3M ownership interests in 3M consolidated entities. The changes in noncontrolling interest amounts are primarily

related to Sumitomo 3M Limited (Japan), which is 3M’s most significant consolidated entity with non-3M ownership

interests. As discussed in Note 6, in the third quarter of 2009, 3M’s effective ownership in Sumitomo 3M Limited was

reduced from 75 percent to 71.5 percent.

Currency Effects:

Currency Effects: 3M estimates that year-on-year currency effects, including hedging impacts, decreased net income

attributable to 3M by approximately $220 million in 2009 and increased net income attributable to 3M by

approximately $160 million in 2008 and $150 million in 2007. This estimate includes the effect of translating profits

from local currencies into U.S. dollars; the impact of currency fluctuations on the transfer of goods between 3M

operations in the United States and abroad; and transaction gains and losses, including derivative instruments

designed to reduce foreign currency exchange rate risks and the negative impact of swapping Venezuelan bolivars

into U.S. dollars. 3M estimates that year-on-year derivative and other transaction gains and losses had an immaterial

impact in 2009, and increased net income attributable to 3M by approximately $40 million in 2008 and by

approximately $10 million in 2007.