3M 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

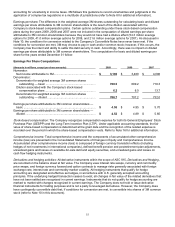

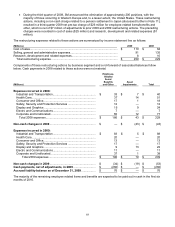

65

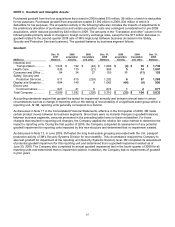

NOTE 3. Goodwill and Intangible Assets

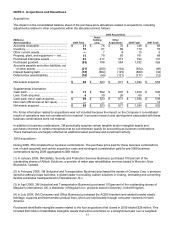

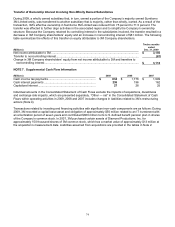

Purchased goodwill from the four acquisitions that closed in 2009 totaled $15 million, $9 million of which is deductible

for tax purposes. Purchased goodwill from acquisitions totaled $1.392 billion in 2008, $34 million of which is

deductible for tax purposes. The acquisition activity in the following table also includes the impacts of adjustments to

the preliminary allocation of purchase price and certain acquisition costs and contingent consideration for pre-2009

acquisitions, which reduced goodwill by $40 million in 2009. The amounts in the “Translation and other” column in the

following table primarily relate to changes in foreign currency exchange rates, except for the $77 million decrease in

goodwill related to the second-quarter 2008 sale of 3M’s HighJump Software business (included in the Safety,

Security and Protection Services business). The goodwill balance by business segment follows:

Goodwill

(Millions)

Dec. 31,

2007

Balance

2008

acquisition

activity

2008

translation

and other

Dec. 31,

2008

Balance

2009

acquisition

activity

2009

translation

and other

Dec. 31,

2009

Balance

Industrial and

Transportation............ $ 1,524 $ 192 $ (24) $ 1,692 $ (4) $ 50 $ 1,738

Health Care ................... 839 170 (21) 988 5 14 1,007

Consumer and Office .... 94 34 27 155 11 (11) 155

Safety, Security and

Protection Services.... 611 815 (224) 1,202 6 57 1,265

Display and Graphics .... 894 140 8 1,042 (44) (8) 990

Electro and

Communications........ 627 41 6 674 1 2 677

Total Company .............. $ 4,589 $ 1,392 $ (228) $ 5,753 $ (25) $ 104 $ 5,832

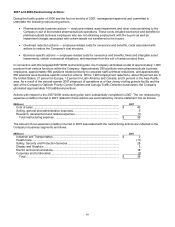

Accounting standards require that goodwill be tested for impairment annually and between annual tests in certain

circumstances such as a change in reporting units or the testing of recoverability of a significant asset group within a

reporting unit. At 3M, reporting units generally correspond to a division.

As discussed in Note 17 to the Consolidated Financial Statements, effective in the first quarter of 2009, 3M made

certain product moves between its business segments. Since there were no material changes in goodwill balances

between business segments, amounts presented in the preceding table have not been reclassified. For those

changes that resulted in reporting unit changes, the Company applied the relative fair value method to determine the

impact to reporting units. During the first quarter of 2009, the Company completed its assessment of any potential

goodwill impairment for reporting units impacted by this new structure and determined that no impairment existed.

As discussed in Note 13, in June 2009, 3M tested the long lived assets grouping associated with the U.K. passport

production activity of 3M’s Security Systems Division for recoverability. This circumstance required the Company to

also test goodwill for impairment at the reporting unit (Security Systems Division) level. 3M completed its assessment

of potential goodwill impairment for this reporting unit and determined that no goodwill impairment existed as of

June 30, 2009. The Company also completed its annual goodwill impairment test in the fourth quarter of 2009 for all

reporting units and determined that no impairment existed. In addition, the Company had no impairments of goodwill

in prior years.