3M 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 114

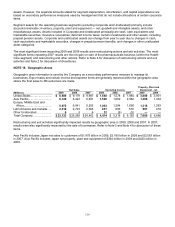

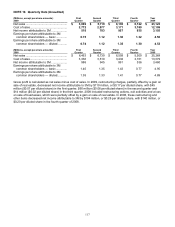

NOTE 17. Business Segments

Effective in the first quarter of 2009, 3M made certain changes to its business segments in its continuing effort to

drive growth by aligning businesses around markets and customers. The most significant of these changes are

summarized as follows:

• Certain 3M window films, such as 3M™ Scotchtint™ Window Film for buildings and 3M™ Ultra Safety and

Security Window Film for property and personal protection during destructive weather conditions, were

previously part of the Building and Commercial Services Division within the Safety, Security and Protection

Services business segment. These window films were transferred to the newly created Renewable Energy

Division, which is part of the Industrial and Transportation business segment. The Renewable Energy

Division consists of current 3M solar energy creation and management products and solutions, as well as

products focused on the renewable energy markets. Renewable Energy’s portfolio includes various 3M

products for solar energy production and solar energy management (such as window films) and also includes

responsibility for wind, geothermal and biofuel-oriented products. The preceding product moves resulted in

an increase in net sales for total year 2008 of $152 million for Industrial and Transportation, which was offset

by a corresponding decrease in net sales for Safety, Security and Protection Services.

• 3M acquired Aearo Holding Corp., the parent company of Aearo Technologies Inc. (hereafter referred to as

Aearo), in April 2008. Aearo manufactures and sells personal protection and energy absorbing products

through the industrial retail channels and certain safety products through the consumer retail channels. The

consumer retail portion of Aearo’s business manufactures and markets personal safety products (including

head, eye, face and hearing products, reflective vests, protective coveralls, and first aid kits) to the do-it-

yourself consumer retail markets. The do-it-yourself retail market portion of 3M’s Aearo business (previously

in the Occupational Health and Environmental Safety Division within the Safety, Security and Protection

Services business segment) was transferred to the Construction and Home Improvement Division within the

Consumer and Office business segment. The preceding product moves resulted in an increase in net sales

for total year 2008 of $49 million for Consumer and Office, which was offset by a corresponding decrease in

net sales for Safety, Security and Protection Services.

Also, during the first quarter of 2009, 3M changed its segment reporting measures to include dual credit to business

segments for certain U.S. sales and related operating income. Management now evaluates each of its six operating

business segments based on net sales and operating income performance, including dual credit U.S. reporting. This

change was made to further incentivize U.S. sales growth. As a result, 3M now provides additional (“dual”) credit to

those business segments selling products in the U.S. to an external customer when that segment is not the primary

seller of the product. For example, certain respirators are primarily sold by the Occupational Health and

Environmental Safety Division within the Safety, Security and Protection Services business segment; however, the

Industrial and Transportation business segment also sells this product to certain customers in its U.S. markets. In this

example, the non-primary selling segment (Industrial and Transportation) would also receive credit for the associated

net sales it initiated and the related approximate operating income. The assigned operating income related to dual

credit activity may differ from operating income that would result from actual costs associated with such sales. The

offset to the dual credit business segment reporting is reflected as a reconciling item entitled “Elimination of Dual

Credit,” such that sales and operating income for the U.S. in total are unchanged.

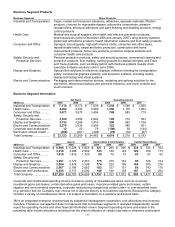

3M’s businesses are organized, managed and internally grouped into segments based on differences in products,

technologies and services. 3M continues to manage its operations in six operating business segments: Industrial and

Transportation; Health Care; Consumer and Office; Safety, Security and Protection Services; Display and Graphics;

and Electro and Communications. 3M’s six business segments bring together common or related 3M technologies,

enhancing the development of innovative products and services and providing for efficient sharing of business

resources. These segments have worldwide responsibility for virtually all 3M product lines. 3M is not dependent on

any single product/service or market. Certain small businesses and lab-sponsored products, as well as various

corporate assets and expenses, are not attributed to the business segments. Transactions among reportable

segments are recorded at cost.

The financial information presented herein reflects the impact of all of the preceding segment structure changes for

all periods presented.